Triggering Tax; On Purpose? You’re Crazy

For most of us, the greatest lifetime expense we’ll have is income tax. My aim is for you to pay the least amount of tax over your lifetime – not necessarily in any given tax year. This can mean withdrawing extra funds from a RRIF or triggering capital gains when you may not need the money.

Yes – triggering tax on purpose.

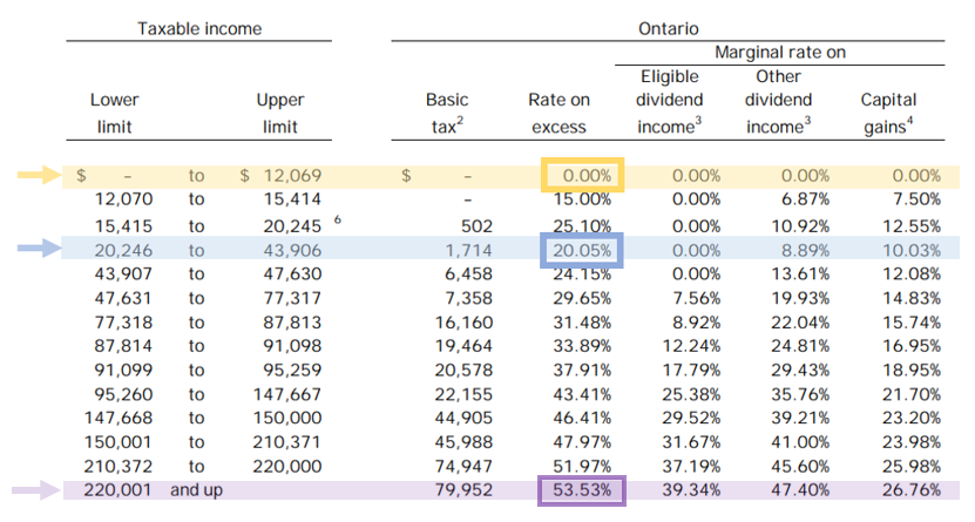

The approach recognizes and takes advantage of the marginal tax rates in our income tax system. Typically, as you earn more, the share going to income tax increases. Below is a tax table courtesy of E&Y which shows the combined Ontario and Federal marginal tax rates. You can see that the first $12,069 of income has a 0% tax rate (yellow) while dollars earned in the $20,246 – $43,906 range are taxed at 20.05% (blue) and those in excess of $220,001 are taxed at 53.53% (purple).

If you look closely, you see that the marginal rates steadily increase except for the 20.05% dip. During retirement, this is a tax sweet spot and if your taxable retirement income is below $43,906 it may make sense to bring it up to that limit. Why? Better to pay at 20.05% in a controlled fashion rather than making an untimely large withdrawal for such things as a roof, health expenses or even death, when all your funds need to be deregistered and considered as income.

https://assets.ey.com/content/dam/ey-sites/ey-com/en_ca/topics/tax/tax-calculators/2019/ey-tax-rates-ontario-2019.pdf

https://assets.ey.com/content/dam/ey-sites/ey-com/en_ca/topics/tax/tax-calculators/2019/ey-tax-rates-ontario-2019.pdf

Looking to Linda for Guidance

Let’s look at two scenarios of a hypothetical client, Linda, to illustrate the point. Linda, 65, is retired and requires $50,000 net a year. She has a $750,000 RRIF and collects full CPP and OAS.

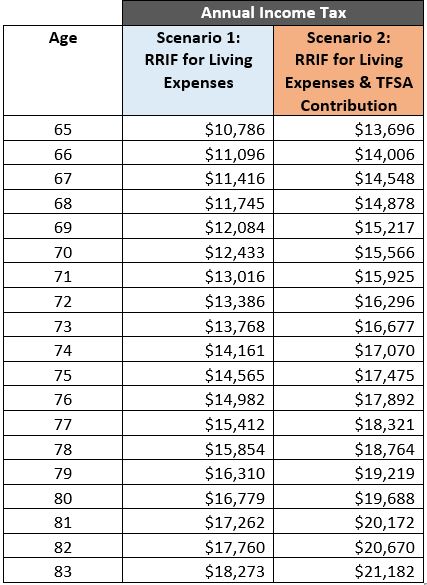

In Scenario 1, Linda withdraws only what she needs while in Scenario 2 she withdraws an extra amount to contribute $6,000 into her TFSA each year. The table below shows her annual tax payments. We can see that she is paying more income tax in Scenario 2. This makes sense because she is taking more out of her RRIF.

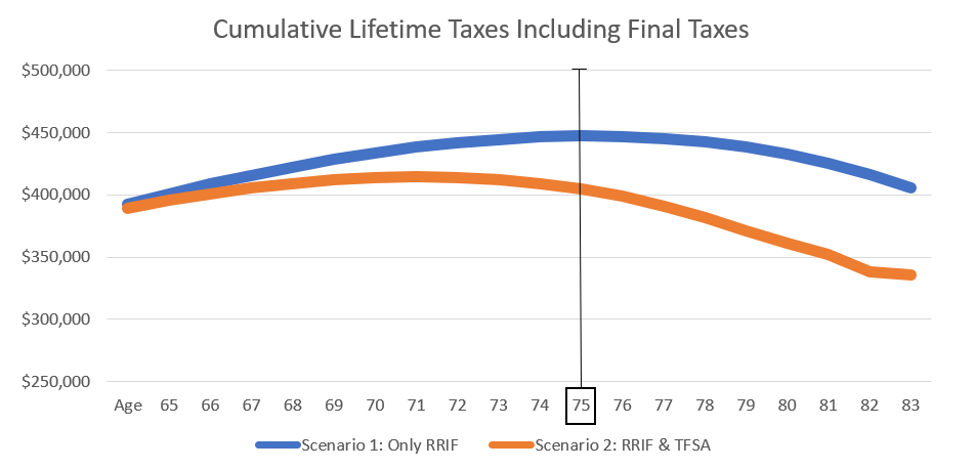

When you add in the impact of taxes paid on death, we start to see a significant overall lifetime tax reduction. The chart below shows the cumulative taxes paid when taxes on death are included. Meaning, if Linda died at age 75, and followed Scenario 1 she would have paid $450,000 in cumulative income tax compared to $400,000 if she had pulled extra funds and contributed to her TFSA in Scenario 2.

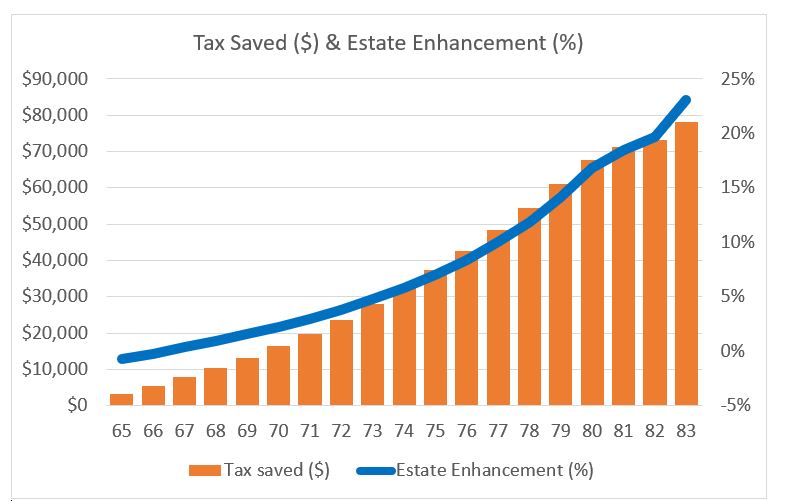

The table highlights the financial advantage of Scenario 2 in absolute dollars and percentage terms. If Linda passed away at age 84, her estate would be over $80,000 larger or enhanced by almost 20%. That’s material.

By following this straightforward strategy, we can help keep more money in your hands and that of your beneficiaries. Let me know if you have any questions.

The above report/graph/table is for illustrative purposes only and does not reflect specific fund performances. Actual results may vary from your investment, savings, loan or other investments available to you. Rates of return will vary over time, particularly for long-term investments. Their values change frequently and past performance may not be repeated.

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.