The 3 Steps in Making an Investment

All too often we distill the idea of a ‘good investment’ to simply buying low and selling high. When deconstructed, investing is more involved and follows 3 distinct steps. Regardless of how sophisticated the investors, consciously or unconsciously, they all follow the same script.

Step #1: Thesis

An investment begins with a thesis or idea. This could be around the future state of a company, sector, commodity, demographic, climatic state or political situation – the list is wide open.

As an example, you could say that Toronto receives over 100,000 people every year and only builds 35,000 units of housing each year; of which are 85% condos. Therefore, demand outstrips supply and prices will naturally rise.

Conclusion: Buy Toronto real estate.

Or, electronic vehicles are set to take over the roads and therefore the price of the minerals that go into the batteries such as lithium, nickel, cobalt, manganese, and graphite are set to jump.

Conclusion: Buy a cobalt mining company.

Both examples are what well known investor Howard Marks would call First Level thinking. He suggests that examples of First Level Thinking don’t provide true investment insight and are in fact the consensus views. It is Second Level thinking that brings novel, counter intuitive perspectives that can generate an investment gain.

As taken from his “It’s Not Easy” memo, First-level thinking says “I think the company’s earning will fall; sell.” Second-level thinking says, “I think the company’s earnings will fall far less than people expect, and the pleasant surprise will lift the stock; buy.”

Step #2: Expression

Once you have your thesis nailed down you need to find a financial method to express it. How are you going to derive an economic gain from your perspective? Is the vehicle a stock, bond, real estate…commodity? Simply because your analysis tells you that oil is set to rise I’m not sure that you are going to rent a oil tanker and captain it across the ocean.

A fitting example of finding a financial expression was highlighted in the movie the Big Short. Here, Michael Burry, the hedge fund investor played by Christian Bale, saw that the US housing market was extremely fragile and was poised to collapse. Ok – he got it right but how was he to going financially express that point of view.

At the time, nothing existed to bet against the housing market. So, what did he do. He went to Goldman Sachs and had them create a vehicle to do just that called a credit default swap on a select group of mortgage bonds. In hindsight, they thought they were taking his money.

Step #3: Timing

Timing: this is probably the toughest of the three. Timing needs to be viewed with regard to time, yes, and underlined by valuation. Suppose that you’re confident in your thesis and you’ve found a method to express it. Perfect. But how is the valuation? Too high? It can be tough – but in those cases you need to be patient.

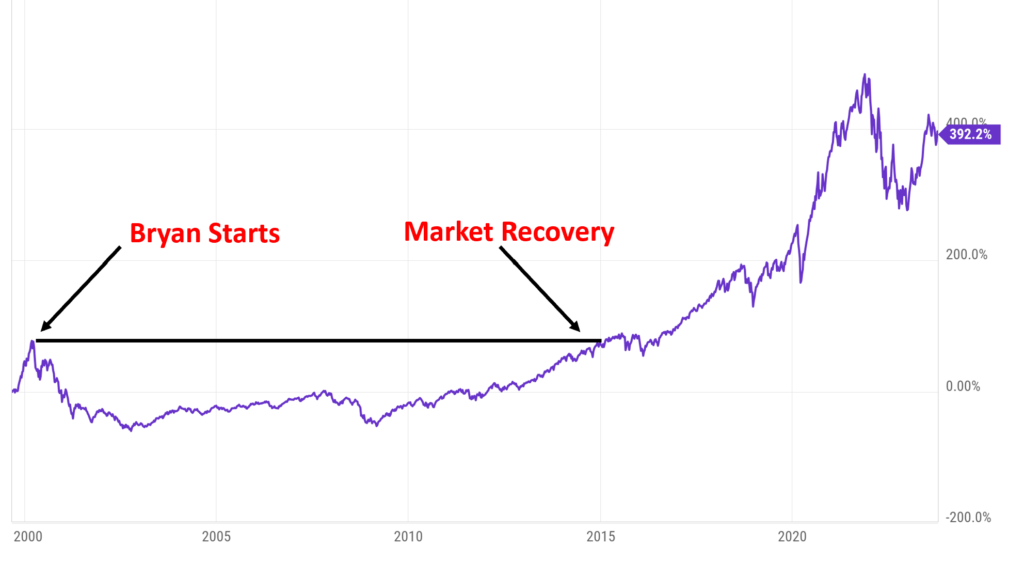

I started in financial services at a mutual fund company on February 24th, 2000 only a few weeks before the internet bubble burst. The frenzy of tech and internet stocks was everywhere. The marketing materials promoted the view that in 5, 10 and 20 years we would all be on high-speed internet with cables running across the ocean floor (that happened), that we would be shopping for all sorts of products on-line (that happened) and that phones would expand into something extraordinary (that happened).

Look around – the thesis came true and at the time there were equities of tech companies to express this viewpoint. The trouble was timing. The valuations were out of control.

Had you bought the Nasdaq when I got my first stack of business cards it would have taken 14 years to recover despite every forecast coming true.

It is usually the timing – more specifically valuation that can get us in trouble.

As you can probably tell, I love this stuff. If you’d like to discuss, please give me a call.

The opinions expressed are those of the author and not necessarily those of Assante Capital Management Ltd. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances. Assante Capital Management Ltd. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.