Avoiding Investment Seduction: It’s Tough

The Gory Details of Wealth Destruction

Driving By The Rear View Mirror

It may seem obvious that investment wisdom is often reflected in what you don’t have in your portfolio. Avoiding mistakes is just as important as capturing success. However, human perception being what it is, it can be difficult to recognize the importance or even see what didn’t happen. Big mistakes are rarely reported in the media or discussed – certainly not at cocktail parties.

Financial journalists would do their readers a huge favor by having an investment obituary page. Rather than stoke envy (FOMO in today’s lingo) with stories of things that went to the moon, it would be good for investors to be occasionally reminded of how easy it is to court disaster.

Picture this: a new sector or idea begins capturing the zeitgeist, and financial promoters seize the opportunity by creating enticing products. “Crypto is the future – we’ve got a Bitcoin fund”. “Marijuana will revolutionize the medical and alcohol sectors – we have you covered”. The seduction beings.

Thematic Investing: A Tempting Tango with Disaster

Morningstar, an investment data firm, regularly publishes research showing how individual investors consistently underperform the markets and investments they are actually invested in. In November Morningstar reported that investors in funds (including ETFs) that followed a specific investment theme such as technology or ESG missed more than two-thirds of the returns generated by those funds over a five-year period to June 2023.

The study found that while the average annual return from the funds was 7.3% a year over the five years, the average investor in those funds saw a return of only 2.4% year, a shortfall of nearly 5% per year. ETFs (Exchange Traded Funds), frequently touted for their low fees and intra-day tradability, fared even worse: energy transition ETF investors suffered a shortfall of 11.9%, and technology ETF investors’ shortfall was about 7%. That’s 11.9% and 7% annualized per year, for 5 years. (1)

Case Study: ARKK Innovation Fund

One of the technology funds mentioned in the Morningstar study is ARKK Innovation lead by Cathie Wood.

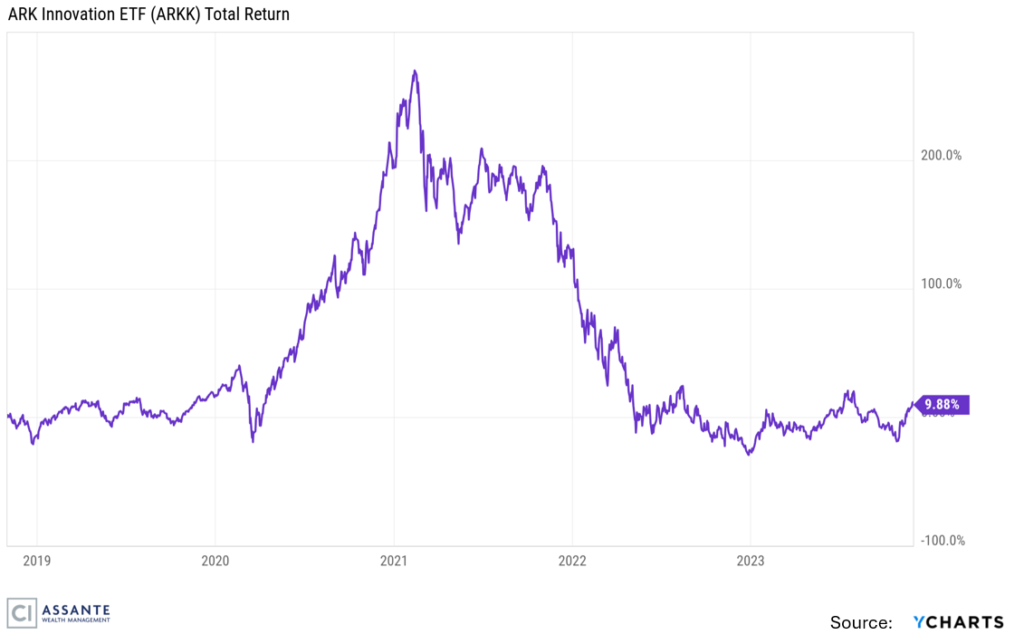

The 5-year return on the ARKK Innovation fund is 1.9% per year (Nov 2023, all data from YCharts). You might then think that the average ARKK investor in the fund earned 1.9% over the past 5 years – where a $1,000 investment grew to about $1,100. The story is way more interesting.

Five years ago the ARKK Fund had about $1 billion in it. Yet the total dollars lost in ARKK Fund over the past 5 years is about $17 billion. What?! How do you lose $17 billion in a fund that was $1 billion in 2019? How do you lose $17 billion when the fund had a 5-year annual rate of return of 1.9%?

Here’s how it happened: In 2019, ARK fund’s $1 billion had a return of 36%. So that $1 billion would be $1.36 billion. But people (I can’t call them investors) added some money to the fund, so that at the end of 2019 it had $1.8 billion in assets. So far so good.

In 2020 the return was an eye-popping 158%. This means the $1.8 billion at the beginning of 2020 would have grown to about $3 billion by the end of the year. It was in this year that Cathie Wood, the portfolio manager, was named the best stock picker of 2020 by Bloomberg News editor-in-chief emeritus Matthew A. Winkler. Let’s all guess what happened next.

After the spectacular performance in 2020 about $24 billion of new money poured into the fund, so that by February 2021 total assets were $27 billion.

Unfortunately, this new money arrived just in time for a minus 23% return in 2021: the $27 billion fell by 23%. It gets worse: the decline of 23% was followed by a minus 67% return in 2022. So the $27 billion peak assets suffered a staggering 75% loss over the following 2 years. It works out to a loss of about $17 billion.

The saga continues: with the rebound in markets in 2023, the return to November is +50%. Technology theme stocks are leading the market again, yet people have pulled $825 million from the fund – even as it has gained 50%! It’s the mirror image of the previous years: people are taking money out after being clobbered by the loss, just in time to miss the gain – but it’s just as destructive as putting money in after the gain just in time to get clobbered by the loss.

The industry term for getting thrashed both ways is ‘whipsawed’; I call it ‘driving by the rearview mirror’. Either way, it is incredibly destructive behavior.

Be sure to check out the video at the 3 minute mark where we visually show the story unfold.

Conclusions & Lessons

One message from this painful story is another of the golden secrets to successful investing. Investment success is not about trading rapidly, or unique insights, or nice new ideas, or inside information. It is about temperament: it is about not chasing 150% returns thinking that ridiculous good luck will be repeated.

It is about investor behavior: having the courage to stay invested in your high-quality long-term investments, even as others silently chuckle at you for being out of fashion and internally fight the urge to scratch the FOMO itch.

It is about not putting money into whatever has shot the lights out in the last block of time. It is realizing and deeply considering that human nature instinctively reaches for whatever has just shot the lights out, that this instinct is extremely hard to resist, and that acting on the instinct is often fatal to the capital involved.

The instinct runs deep: we survived the last 10,000 years noticing that the rabbit tends to run one day where it ran the day before.

A good advisor acts as an emotional counterweight – providing the courage to persevere in times of fear and fortitude to stay the course when everyone else seems to be getting rich and passing them by.

If you have any questions, feel free to reach out to us.

(1) https://www.ft.com/content/4dc6972e-11d4-48a2-b5ba-319b520a0f62?shareType=nongift

The opinions expressed are those of the author and not necessarily those of Assante Capital Management Ltd. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances. Assante Capital Management Ltd. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.