If it is Important Make a List

All too often we think that once we have our wills in place that our estate planning is complete. Conceptually this is true – the will does layout how you want your assets distributed. The will, however, does not leave a detailed accounting of your financial touchpoints. Where does your executor start? What are your assets? Who do they call? Where do they find that information?

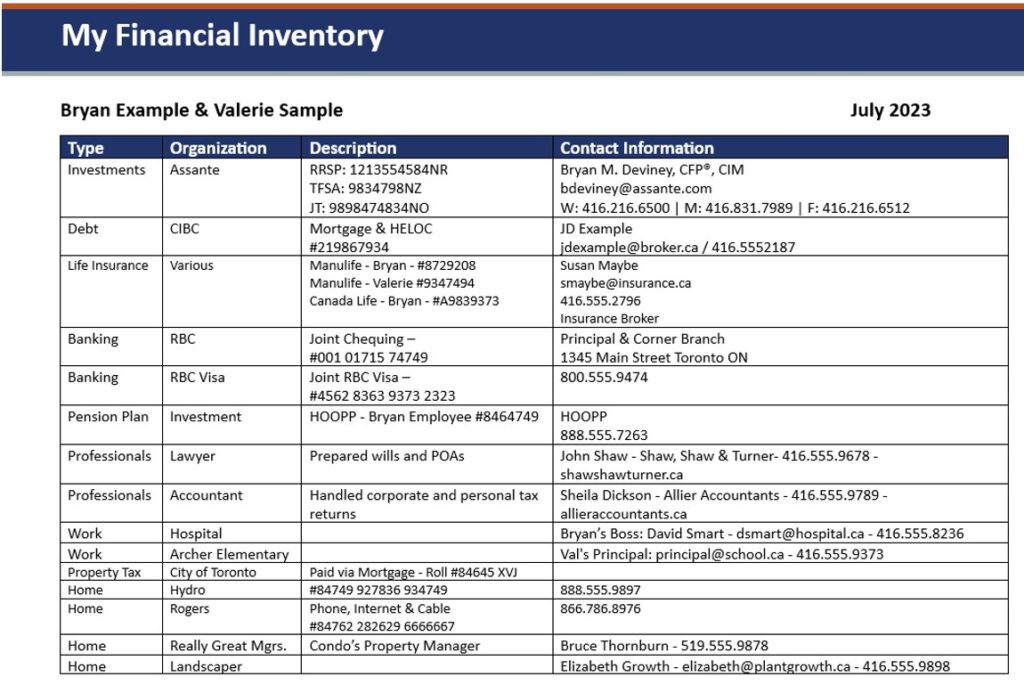

This is why we suggest that clients put together what we call Your Financial Inventory.

There are four central categories that you should highlight: type of asset, organization, description and contact information. As an example, for your investments you would put: investments as the Type, Assante as the Organization, RRSP, TFSA and joint account with the corresponding account numbers in the Description and my Contact Information. Easy. Then maybe you have a mortgage to add. Life insurance policies. Bank accounts. Credit cards. Pension plan details. Relationships with a lawyer or accountant.

We even suggest adding house related items like property tax, hydro account number, condo corp details or landscaping information.

We don’t feel that it is critical include market value information. We want this summary to be easily passable to a sibling or adult child while you are alive. And, that’s probably more easily done if the summary contains no sensitive information. Knowing how much is in your RRSP is not relevant compared to knowing where it is located.

How far of a net do you cast? You may want to include your internet provider, cell phone provider, dog walker – even email and FaceBook details.

So, I know what you are thinking. This is going to take me hours – even a complete weekend. I can assure you that it does not. Once you get on a roll you’ll find that you can summarize the majority of your financial affairs in 30-40 minutes.

Providing a roadmap for your executor and surviving family will make it much easier for them to handle the time consuming and, at times, daunting administrative aspects that come with someone dies.

If you need help putting this together please give us a call. We are happy to help.

Bryan Deviney is a Senior Financial Advisor with Assante Capital Management Ltd. The opinions expressed are those of the author and not necessarily those of Assante Capital Management Ltd. Please contact him at 416-216-6500 to discuss your particular circumstances prior to acting on the information above. Assante Capital Management Ltd. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.