Your Withdrawal Rate - Perhaps the Most Important Number for Your Retirement

One of the most important tasks facing any prospective retiree is determining how much money they can take out each year with confidence that they won’t run out of it. This is called the withdrawal rate and is expressed as the percentage of funds coming out of the savings pool in any year. If someone was withdrawing $25,000 of their $500,000 portfolio, they would have a 5% withdrawal rate.

So, what is a sustainable level? Intuitively, I think we all have a sense that taking out 1% of our portfolio each year would provide sustainable income over a lifetime whereas taking out 10% a year would lead to ruin after a few short years.

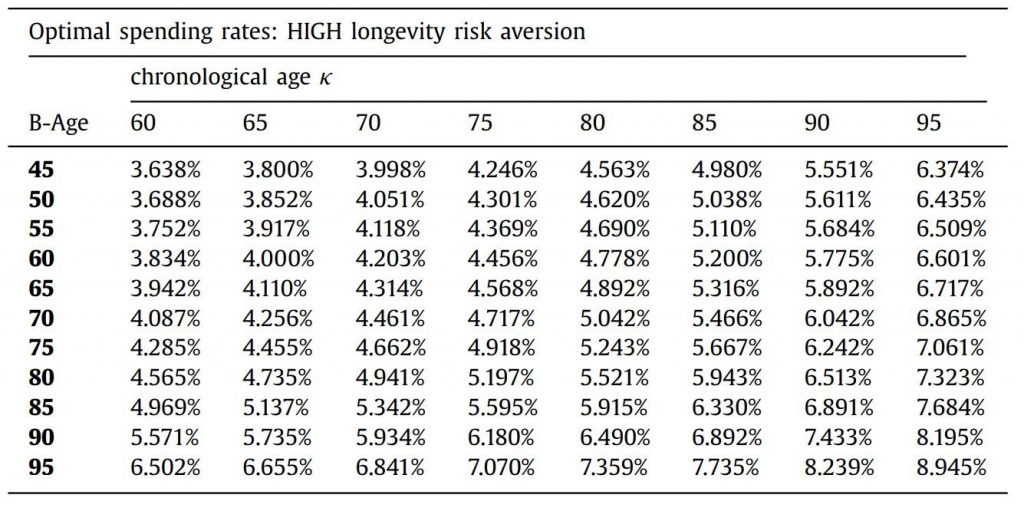

Mosche Milevski, Professor of Finance at York University, has devoted much of his career around the study of retirement. His analysis concludes that a 65-year-old should be withdrawing 4.110% of their portfolio each year. The table below highlights the sustainable withdrawal rate for various chronological ages (how old you are) and biological ages (how healthy you are).

Source: https://moshemilevsky.com/wp-content/uploads/2018/02/Article_1.pdf

Source: https://moshemilevsky.com/wp-content/uploads/2018/02/Article_1.pdf

Many ask why it is necessary to take out less than the rate of return that your portfolio has, or is anticipated to generate. The reason lies in the variability of returns. While your portfolio may have a historical annualized rate of rate of return of 6.5% - the returns fluctuate year to year. Some years may have seen double digit growth while others saw flat performance and, unfortunately, other years were negative. If you start pulling out funds in a negative sequence of returns with a high withdrawal rate your portfolio decline is magnified. A lower portfolio value means that when markets do recover you are not able to sufficiently participate – putting you in a precarious position.

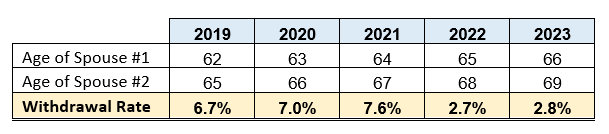

It is not uncommon to have higher withdrawal rates in the early years of retirement. This usually occurs because many retirement income streams, such as OAS, are unavailable before the age 65 , or we simply want to spend more on travel. Below is a real-life example. We can see that the initial years of retirement have significant withdrawal rates which settle down into a sustainable pace once both parties are 65. To help immunize the clients’ retirement income from the negative sequence of returns we have set aside those early withdrawals (6.7%, 7.0% and 7.6%) into low risk investments to minimize the stock market risk.

Your withdrawal rate is a central indicator on the health and suitability of your retirement income plan.

If you would like to go over your withdrawal rate in more detail, please give me a call – 416.939.2000.

![]()

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.