Thoughts on U.S. Presidential Elections & Investing

Lately, one of the most frequent questions is about the upcoming U.S. presidential election and how it will impact our portfolios. This topic, much like the recent heat wave or the Olympics, is on everyone's mind. Still, I sense that embedded in the question is a view, or fear, that one political party will lead to prosperity while the other will bring hardship.

My goal today is not to choose sides but to provide some context.

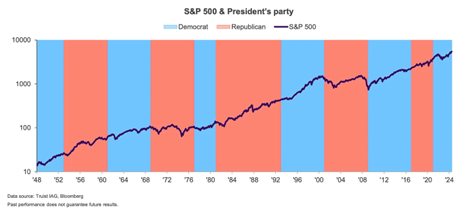

I've found two insightful charts that can help us understand the situation better. The first chart, created by Truist's co-CIO Keith Lerner, illustrates the S&P 500's performance since the post-war era, with red and blue colors indicating which party was in power—Republicans in red and Democrats in blue.

What can we deduce from this chart?

- It doesn't seem to matter whether Democrats or Republicans are in power

- The market tends to rise in most years

- The down years are shared between both parties

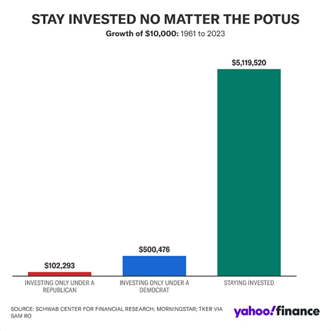

Now, let's move on to the second chart, which presents three different investment strategies and their outcomes. The first strategy involves investing only when Republicans are in power. The second strategy only invests when Democrats are in power. And the third involves staying invested regardless of which party is in power.

The results, provided by the Schwab Center for Financial Research, are noteworthy. From 1961 to 2023, a $10,000 investment in the S&P 500 during only Republican years would grow to $102,000—a tenfold increase. Investing only during Democratic years would turn $10,000 into $500,000—a fiftyfold increase and five times more than the Republican approach. Now, consider the third strategy, where you remain invested from 1961 to 2023, regardless of the party in power. Here, the $10,000 grows to an astonishing $5,000,000.

The stark contrast between staying invested and being partisan is undeniable. The power of compounding is at the heart of this difference. By sticking to one party, you miss out on decades of positive returns that compound into something truly extraordinary.

Our conclusion therefore is that it is better to not be distracted by today’s media hype and keep our focus instead on the long-term. It sounds boring but the outcome of following this approach is undeniable.

As always, if you have any questions feel free to give us a call.

The opinions expressed are those of the author and not necessarily those of Assante Capital Management Ltd. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances. Assante Capital Management Ltd. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization.

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.