They Don't Ring a Bell at the Bottom

A day cannot pass without hearing about the unprecedented nature of the times we are living in. We are all trying to stay safe, follow the rules and wash our hands profusely. Sweeping changes in how we shop, interact, educate and entertain ourselves has also brought understandable anxiety. This uncertainty first revealed itself in financial markets near the end of February was fully visible on our March 31st statements.

What March 2020 Looked Like

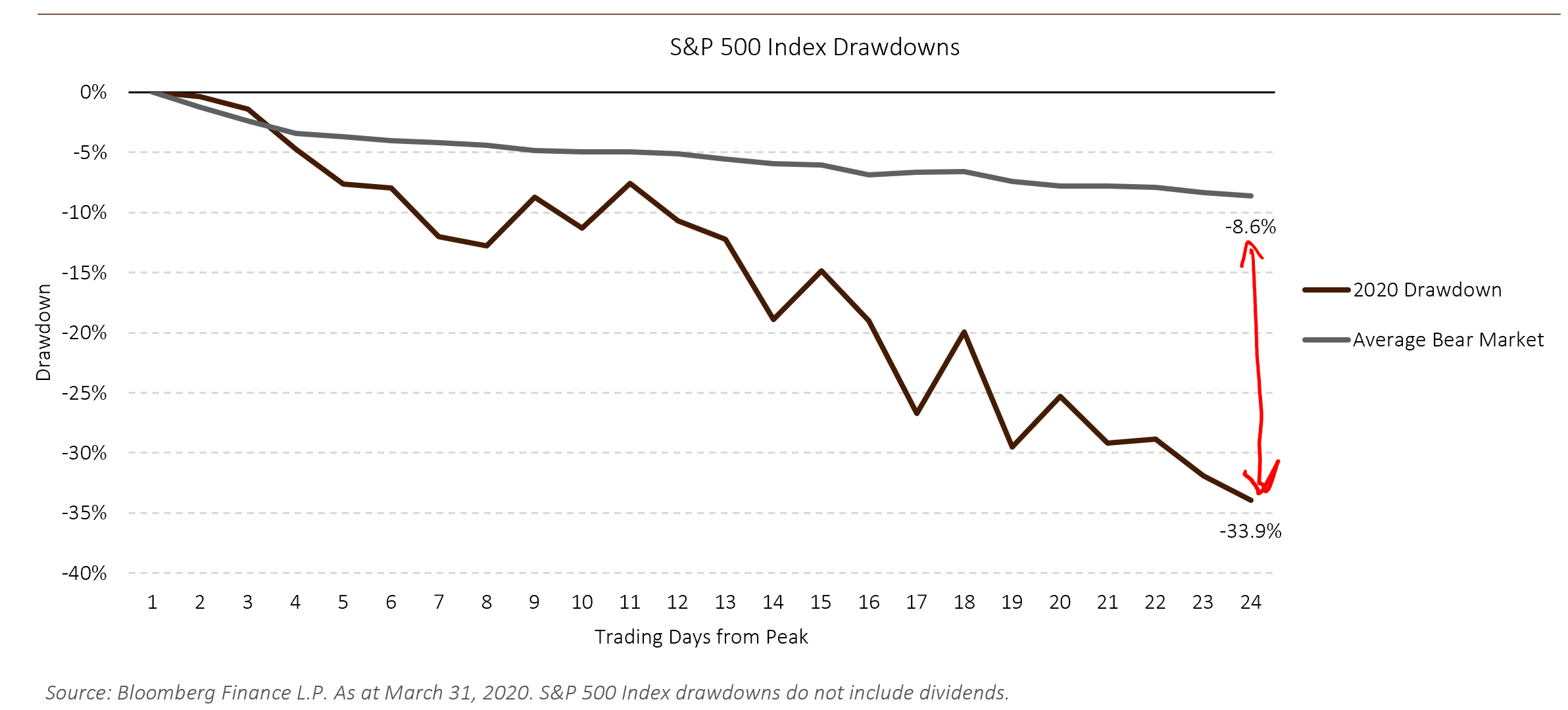

This is my third great market shock of my professional life (the Internet Bubble / 9/11 and the Financial Crisis were the others). The depth of the decline is not distinct from other bear markets. In fact, it falls within average bounds but what distinguishes it is the speed and sharpness of the decline. In 24 days, the S&P500 fell by 34.9% from its peak (as at March 31st). If averaged out, a typical bear market would have seen a loss of 8.6% during the same period. What was the cause of this sudden retreat? Algorithmic trading, hedge funds, margin calls? Maybe a little on the margins but the true culprit was fear. Investors were fearful about the unknown future and pushed their way to get out.

And, the million-dollar question is: Was that fear warranted?

Terminal Uniqueness

Investing guru Nick Murray summed it up well in 2009 when he said that “…there is a very human tendency, when we are overtaken by shocking events like this [referring to the financial crisis], to see them as being terminally unique.” Meaning, we lose the ability to put the current situation in any sort of historical context. In March, investors followed the script and chose to believe that today’s problems were insoluble.

Every bear market is unique but as they say about history – it may not repeat but it does rhyme. This challenging period may have its own nuances and complexities, but it is not different. A few examples:

- The exuberant valuations and subsequent crash of the 1990 Dot.Com bubble echoed that of the Nifty Fifty crash in the 1970s.

- The excessive leverage that triggered the Great Depression resembled that of the Great Financial Crisis.

- We have also seen severe flus like the Asian Flu (1957–1958) which killed 1-4 million people worldwide and 116,000 in the US and the Hong Kong Flu (1968–1969) which killed 1 million people worldwide and 33,800 in the US. And, recall that the U.S. population was about half what it is today during those periods.

Ok - the cause feels and is distinct; especially for the group going through it. These times are scary and create fear and pessimism. However, history instructs us that we humans solve our problems and move forward.

What is Fair Value

Investment textbooks and folks like Warren Buffet tell us that the value of a company is the sum of its future earnings. If future earnings are anticipated to be dampened, then you would expect a stock’s price to decline. This makes sense. But, is the amplitude of the recent decline disproportionate or proportionate to the coming economic outlook? Perhaps for some companies - maybe not for all.

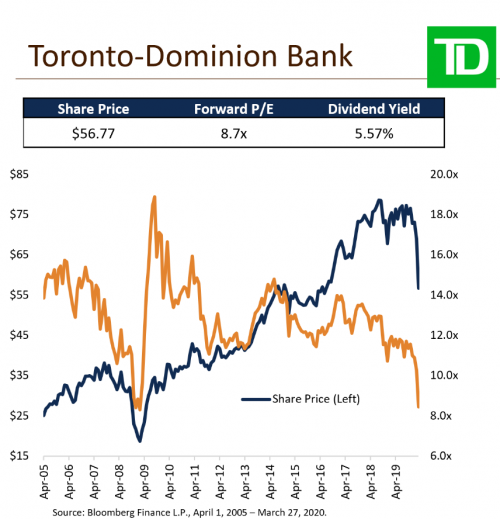

Let me use TD Bank as an example. In the chart below, we see that the share value declined by almost 30% to $56.77 (blue line). Will TD’s profits be hurt by a tightening economy? Absolutely. Do I think that their profitability will be permanently impaired? I do not think so.

TD Bank - Let’s Dive In

Suppose that TD’s stock pre-Covid stock price fairly valued the next 10 years of earnings. Now comes the pandemic and they don’t have any earnings for 4 quarters or 1 year. That would mean that 1 of 10 years of profit did not come through. To me, that says that the stock should be down 10% not 30%. And, not one Canadian bank CEO has suggested that they are planning to cut their dividend which typically comes from profits.

One method to gauge whether a stock is cheap or expensive is to look at the price-to-earning ratio. This tells you how much investors are willing to pay for one dollar of earnings (orange line). The chart informs us that at 8.7x earnings ‘the market’ see TD Bank in the same spot as they were in during the Financial Crisis (a bank’s most existential moment since the Great Depression).

A more typical bank valuation is 14x earning. So, let’s assume you bought TD at 8.7x and waited for confidence to return to markets. If TD never made one more dollar in profit you would see a capital gain of 60% as it climbed back to 14x.

It is my contention that TD Bank, along with people, families and businesses, will muddle and struggle through this period and move towards more predictable times.

They Don’t Ring a Bell at the Bottom

I often get asked: when will we bottom or have we hit the bottom? Frankly, I do not know and as the cliché goes “they don’t ring a bell at the bottom.” We may have seen it. It may be around the corner. It would be disingenuous of me to say that I have a feel on where markets will be in 1 or 3 months. What I have clarity around are the prospects for 3, 5 and 10 years out. Those are the time frames that bear the weight of your financial plans and lives.

No one can predict the future. As acclaimed investor Howard Marks stated (and I am paraphrasing): you can’t predict the future but you can position yourself for the most likely and probable outcome. My assertion is that the most likely outcome is that we exit this situation and make a handful of mistakes along the way. If that is the case, then the assumptions around your financial and investment plans are still intact. Deserting your plan today would provide a moment of relief followed by a lifetime of regret.

If you would like to talk about anything financial planning or investment-wise please give me a call.

In the meantime, enjoy an early morning walk, vacuum the winter mess out of your car or order a meal from the local restaurant you have never tried.

Be well.

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.