The Power of Compounding

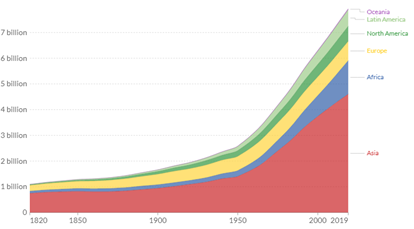

The terms ‘compounding’, ‘compound interest’ or the ‘compound effect’ are ubiquitous in the realm of personal investing. Compound interest is the effect of earning interest on interest otherwise known as geometric growth. If we take a step back, we’ve witnessed the hockey stick power of geometric growth many times before in such areas as the:

- the world’s population (remember Malthus),

- the number of transistors in a computer chip (CPU) known as Moore’s law or

- that huge snowball you rolled in the school yard in Grade 5.

(Have a look at the charts below to see their explosive growth.)

Whether we can internalize the effect or not I think we all understand that compounding can have a positive impact on our portfolios. Still, the positive outcomes are not a given. As such, I wanted to share 3 central lessons, or observations, around compounding and personal investing - each occurring at a different life phase.

1. At first, it takes times.

Imagine you are a twenty something and have started to set aside money for retirement. Perhaps you manage to set aside $400 a month in your RRSP. You’ve chosen a great advisor and they’ve managed to consistently earn you 8% a year. How long will it be before you reach $100,000? Somewhere in the 13th year. That will take a lot of patience – especially in today’s world of instant gratification. Guess how long it takes to achieve $200,000? Only 6 years later. The snowball starts to take form and grow. And, $300,000? Only 4 years later.

2. Retirement Can Feel Unachievable at 50.

I’ve sat down with many people in their early 50s and laid out where their nest egg needs to be in 10ish years. Straightforward enough. Not really. It can feel unfeasible. Let me give you an example. Imagine that a 50-year-old had $500,000 today and needed $1,500,000 by the time they reached their early to mid-60s; and I confidently said it was doable. “That’s tripling the portfolio. How’s that going to happen?” they might say. Well, with $2,000 a month of saving and a 5% hypothetical rate of return it works. The important fact is that they needed to have the $500,000 base in the first place to make this happen. (Note the linkage to the previous point to get the $500,000.)

3. RRIF Withdrawals May Overtake Compounding.

None of us like to see our account value decline, even if it was caused by our own withdrawals. But it may happen with our RRIFs. A RRIF is simply an RRSP when you are taking funds out on a consistent basis. Once in a RRIF, the government mandates a minimum that must come out every year. At 65, the figure is 4.00%, at 75 it is 5.82% and 85 it is 8.51%. What this means is that if the return of the portfolio does not exceed the withdrawal amount each year it may start to decline in value. This can be a normal outcome and is in fact the government’s desired outcome. RRSPs and RRIFs were created to provide non-defined benefit pension workers with an equivalent tool to grow their retirement savings. And, like a pension, the government would prefer that there be no value remaining on your death.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.” Einstein said that and this quote is abundant in the financial world. But I would argue that the second half of realizing the power of compound interest is having the personal attribute of patience. “Patience is not simply the ability to wait - it's how we behave while we're waiting.” That was Joyce Meyer and being patient and committed to a plan for years is challenging for any human being.

The World's Population Growth

Source: https://ourworldindata.org/world-population-growth

The Average Number of Transistors in a CPU

Source: CI Global Asset Management – Surfing The Wave of Innovation – April 7, 2021

https://en.wikipedia.org/wiki/Transistor_count

Huge School Yard Snowball

Source: A Wonderful School Yard This Past Winter

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.