Tax Considerations When Making Investment Decisions

We often make investment changes to enhance our potential returns, lower the downside risk or reposition for an upcoming withdrawal. Making these changes in a registered plan like TFSA or RRSP are straightforward – just sell and buy. No fuss no muss.

In a non-registered account there may be a capital gain to consider which could translate into a tax bill or even a one-year loss of Old Aged Security. So, what seemed like a no brainer decision in your TFSA now feels much more complicated – even punitive.

So, the bottom-line question: does it make sense to take one step backwards, that is paying tax, in order to put you in a more optimal investment mix?

We often like to say that we don’t want tax to wag the investment dog but we can’t hide the fact that tax is a reality that needs to be considered.

Let’s look at an example, Dennis Smith, to get a sense of things.

Suppose Dennis has a $1 million RRSP. We present an investment opportunity to switch to an investment poised to return 7% instead of his current 5%. Forecasting this out, in 10 years the account could increase to $1.84 million instead of $1.55 million. No doubt Dennis would tell us to go ahead.

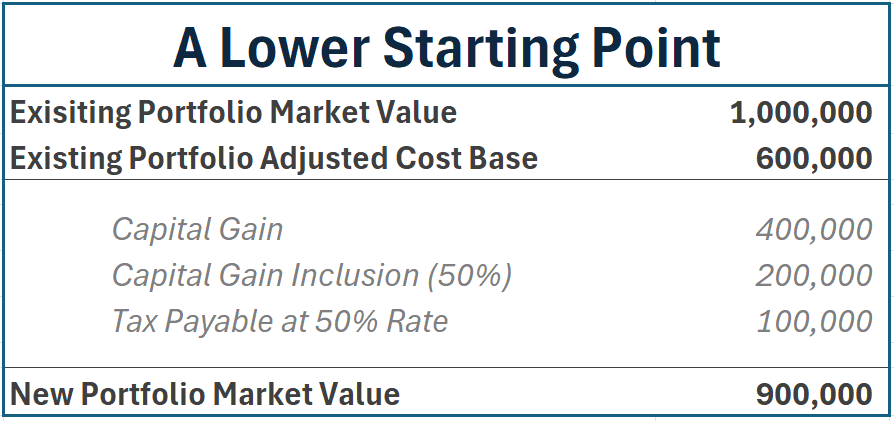

Now, in his non-registered plan Dennis also has $1 million. The account has an adjusted cost base or tax base of $600,000. Meaning, that he would realize a capital gain of $400,000 if we made the move. Of that $400,000, based on today’s rules 50% is taxable. That $200,000 would then be stacked on top of his other incomes. And, assuming that Dennis is in the 50% marginal tax bracket he would pay $100,000 in tax.

So, conceptually, after Dennis’ pays the tax bill his $1 million is now $900,000 – a lower starting point. So, does it make sense to take one step backwards to return 7% instead of 5%?

I can feel Dennis is a little more apprehensive compared to his RRSP decision.

There are two dimensions that we need to look at to get a fuller perspective. I call the first: the statement view while the other is called: the in-your-pocket view.

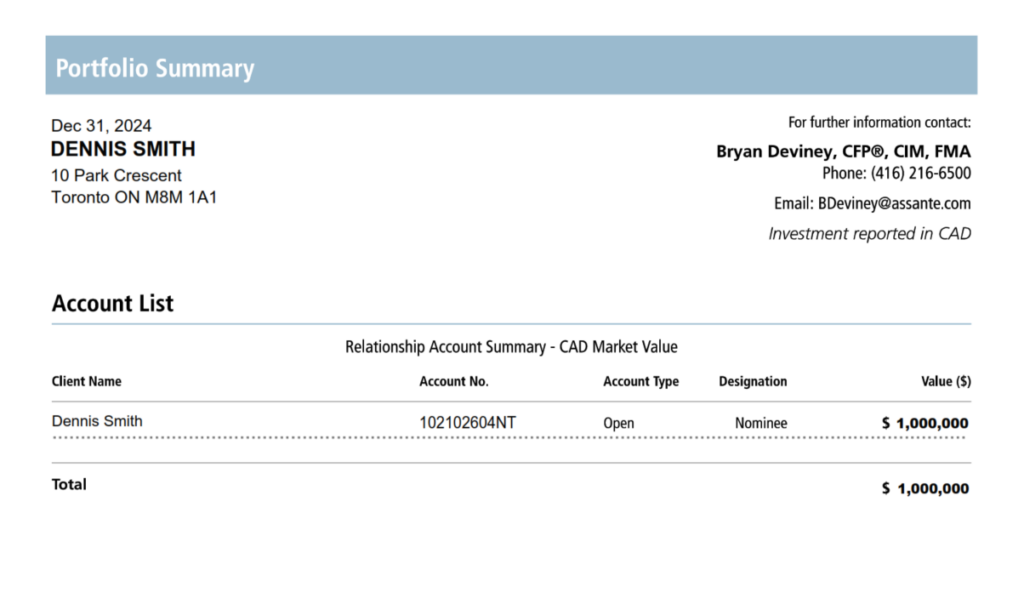

The statement view is what you see on your Assante statement each quarter – each year end. Have a look at this mock up.

The other figure is the in-your-pocket view – meaning what is actually yours after you pay the tax man. For Dennis, his $1 million statement view translates into $900,000 in-your-pocket after you pay the taxes.

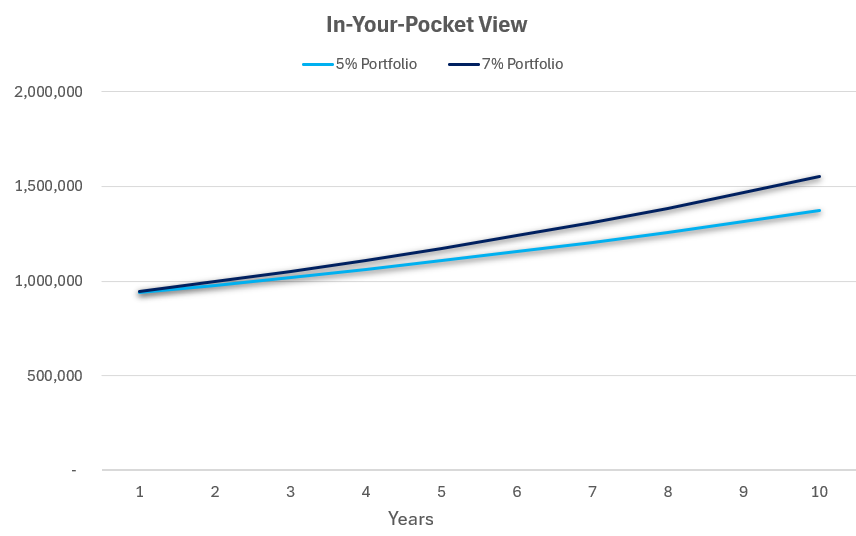

The other figure is the in-your-pocket view – meaning what is actually yours after you pay the tax man. For Dennis, his $1 million statement view translates into $900,000 in-your-pocket after you pay the taxes.

Make sense. Let’s keep going.

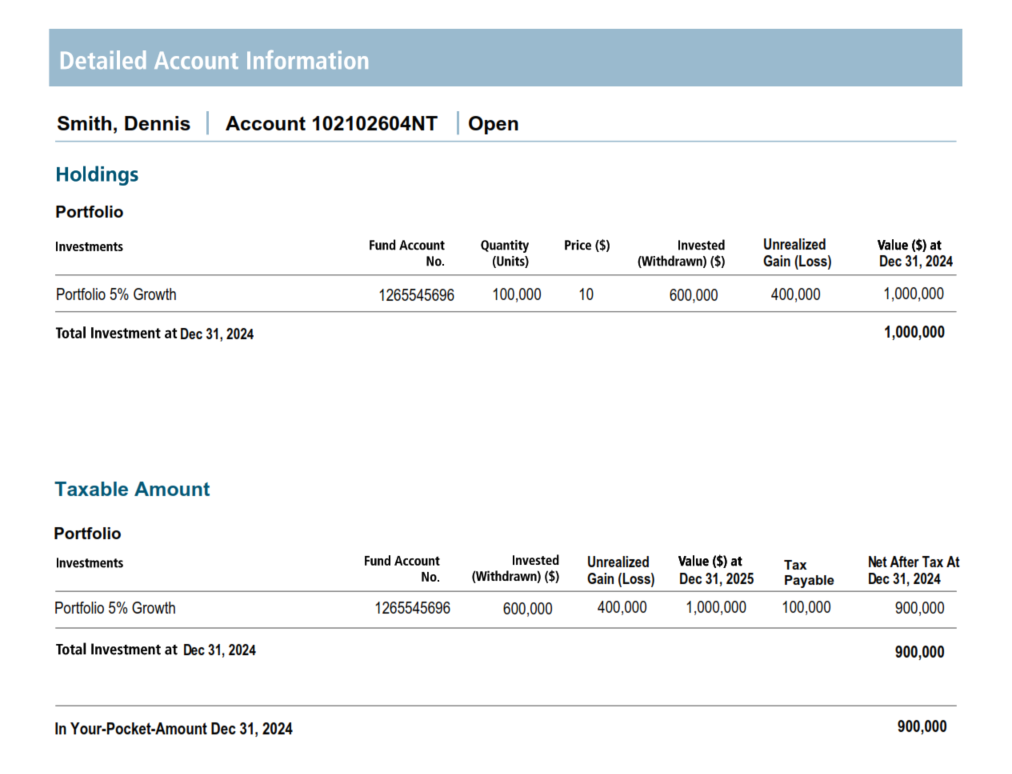

Let’s have a look at Dennis. If he kept his 5% investment it would grow to $1,050,000 at the end of year 1, $1,102,500 at the end of year 2 and $1,157,625 at the end of year 3. This compares to the statement view of his 7% investment at $963,000 at the end of year 1, $1,030,410 at the end of year 2 and $1,102,539 at the end of year 3.

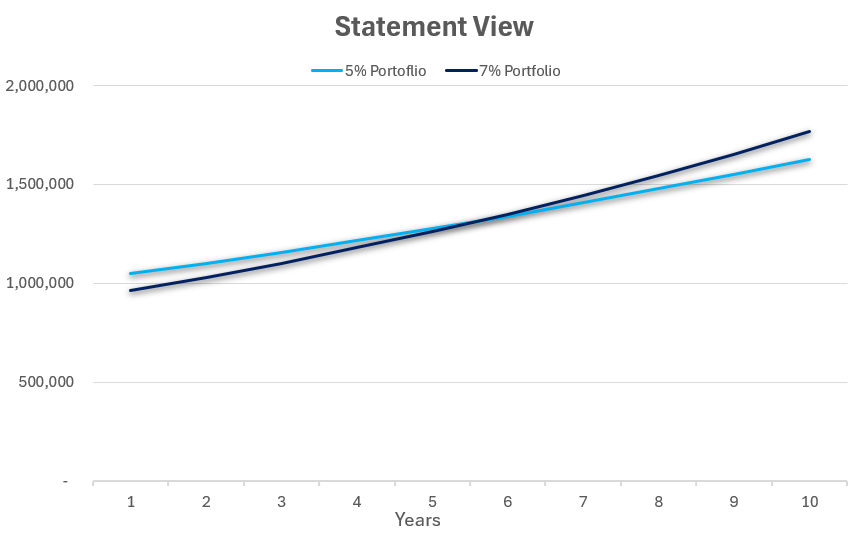

Have a look at the comparison over the next 10 years. It is only in year 6 that the 7% portfolio overtakes the old 5% from the statement point of view.

So, do you have to wait 6 years to feel good about your decision?

If we look at the in-your-pocket view we see that if he kept his 5% investment it would grow to $937,500 at the end of year 1, $976,875 at the end of year 2 and $1,018,219 at the end of year 3. This compares to the statement view of his 7% investment at $947,250 at the end of year 1, $997,808 at the end of year 2 and $1,051,904 at the end of year 3.

Have a look at the comparison over the next 10 years. The new 7% investment overtakes the original 5% one after year 1 from an in-your-pocket point of view.

So, which is paramount? Statement or in-your-pocket? They both need to be considered and, of course, there are no guarantees that the 7% will come to fruition.

What determines the breakeven?

The two determinant variables are the relative size of the unrealized capital gain and your marginal tax rate. The larger the capital gain the longer it takes for the new investment to overtake the old one from the statement and in-your-pocket point of view. Similarly, the higher your marginal tax rate the longer it takes for the new investment to overtake the old one from the statement and in-your-pocket point of view.

Paying tax is no fun especially when you are the one pulling the trigger. At the same time, if the investment change has material merits - taxes should play a second seat.

As always, if you have any questions let me know.

Bryan Deviney is a Senior Financial Advisor with Assante Capital Management Ltd. The opinions expressed are those of the author and not necessarily those of Assante Capital Management Ltd. Please contact him at 416.216.6500 or visit www.bryandeviney.com to discuss your particular circumstances prior to acting on the information above. Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization.

The case study mentioned in this presentation is provided for illustrative purposes only and does not represent an actual client or an actual client’s experience, but rather is meant to provide an example of our process and methodology. The results portrayed is not representative of all of our clients’ experiences.

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.