Market Volatility & Your Portfolio

Multi-asset investing in challenging times

A commentary on recent market volatility by CI Investment Consulting

Alfred Lam, CFA, Senior Vice-President & Portfolio Manager

Yoonjai Shin, CFA, Vice-President & Associate Portfolio Manager

August 24, 2015

Global stock markets have posted large declines in recent days. A weak Chinese economic outlook, combined with very limited avenues to “short” China, has contributed to a temporary sell-off in related asset classes. It started with lower oil prices, then weakness in the global energy sector, which affected the Canadian and Australian equity markets with their large energy exposure. More recently, the selling has included any type of equity. On the other hand, government bonds have performed strongly on expectations that interest rate increases will be postponed.

Our portfolios are engineered to assume that market corrections will appear on a random basis. Portfolios created for conservative investors who intend to hold their investments for the short term are positioned defensively with substantial exposure to government and high-quality corporate bonds. These investments in general have lower volatility than equities, at the expense of long-term return expectations. As can be expected, the sudden correction in the equity markets has allowed these investments to appreciate in value very quickly, helping to reduce overall portfolio volatility at the right time.

For the portfolios that are designed to capture higher longer-term growth through more exposure to stocks, the recent correction does not change our long-term return expectations. Corrections have always been followed by a recovery; over the long term, extreme market movements are simply noise. Unless the investments were dramatically over-valued or under-valued at purchase, the base case for equity markets is a return of 6-8% on an annualized basis over the long term, resulting from dividends and long-term earnings growth, both of which tend to grow consistently over time. Today, equities are reasonably priced with the price-to-earnings ratio on forward earnings in the S&P 500 Index at approximately 15 times.

Portfolio positioning and expectations

Investors are coming to the realization that it remains challenging for the global economy to achieve reasonable growth. The Federal Reserve and other central banks are unlikely to raise rates in the near term given weaker growth prospects, extending the accommodative environment for longer than previously thought. In today’s world of low economic growth, low inflation, and zero policy rates, the backdrop is actually quite attractive for multi-asset investing.

We are constructive on the bond markets given that while expected returns are low, the potential downside should also be low. We seek to get paid above-inflation rates and will adjust our exposure to changes in inflation expectations and market interest rates. We own a fair amount of government bonds across the portfolios and are watching their valuations very closely to find opportunities to reduce exposures.

Foreign currencies have rallied as lower oil prices and lower economic growth in Canada have hurt the loonie relative to other major currencies, including the U.S dollar, the yen, the euro and the pound. We believe the concerns for Canada are legitimate but the valuations of our dollar have been adjusted to reflect them. We are more inclined to own the Canadian dollar today than a few years ago. This is reflected in our higher currency hedge ratios, which reduces foreign currency risk.

It is impossible to determine when the stock markets will bottom. Our long-term portfolios had the optimal asset mix going into this correction. We are not seeing a need to change the overall strategy due to short- term challenges, as we do not expect our investors to change course. We are therefore not changing the strategic asset mixes at this time.

As usual, we will make enhancements around our strategic positioning to take advantage of market inefficiencies. At the individual security level, our underlying managers continue to seek opportunities to trade positions for relatively better quality or valuations. At the asset mix level, we continue to rebalance the portfolios to top up equity weightings and continue to monitor and manage country and currency exposures to ensure the portfolios are optimized at multiple levels.

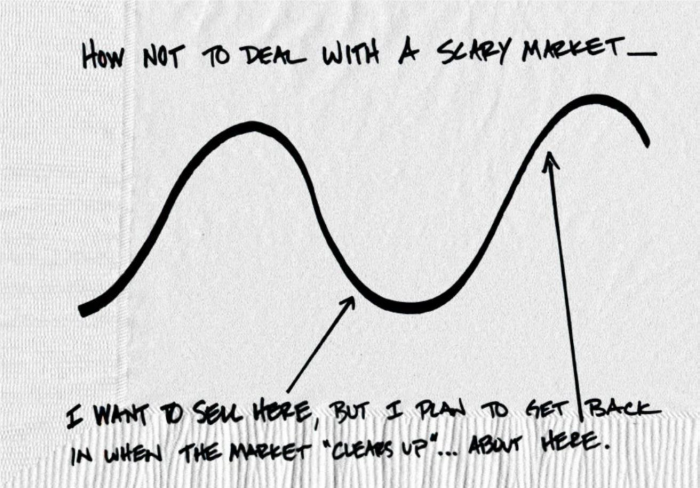

For investors who have committed their money to invest for the long term, they should be reminded that deviations from the original plan tend to bring comfort in the short term, but disappointment in the long term.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. This commentary is published by CI Investments Inc. It is provided as a general source of information and should not be considered personal investment advice or an offer or solicitation to buy or sell securities. Every effort has been made to ensure that the material contained in this commentary is accurate at the time of publication. However, CI Investments Inc. cannot guarantee its accuracy or completeness and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein. This report may contain forward-looking statements about the fund, its future performance, strategies or prospects, and possible future fund action. These statements reflect the portfolio managers’ current beliefs and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments.This commentary is provided as a general source of information and should not be considered personal investment advice or an offer or solicitation to buy or sell securities. ®CI Investments and the CI Investments design are registered trademarks of CI Investments Inc. Published August 2015.

August 25, 2015

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.