Liquid Alternative Investments - Do You Need Them?

In the Fall of 2018, Canadian regulators allowed investment management companies to offer Liquid alternatives. These types of products have existed in other jurisdictions like Australia and the US for many years. These securities give investors from all levels of sophistication and wealth access to strategies normally reserved for high-net worth and accredited investors.

On the ground level what does this look like? On the surface it doesn’t look any different. You are still buying a mutual fund but the investments parameters can be much broader. This allows, the portfolio management team to have more flexibility to express their investment view.

Portfolio managers now have the ability to hold greater amounts of cash than before, greater flexibility on the types of securities they hold and can use short-selling or leverage if they see fit. It does not mean that all liquid alternative investments will employ these tools, but they are now at their disposal.

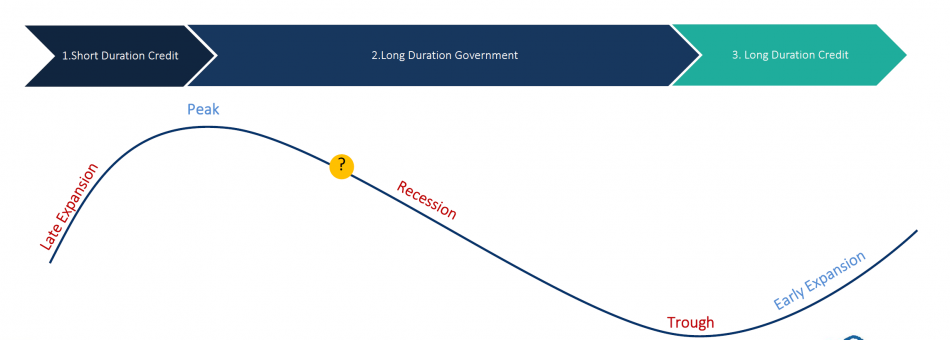

Let me give you an example using the Marret Alternative Absolute Bond Fund. This is an investment mandate that attempts to manage a fixed income portfolio as we move through interest rate and business cycles.

The sine curve you are seeing represents the ups and downs of the business cycle from late expansion to recession to early expansion again. During each period, it is preferable to own one type of bond over another. In the late expansion phase, it is preferable to own short duration bonds like a 2-year Ford bond whereas as we peak and go into recession you want to own long duration government bonds like a 30-year Canadian Government bond. And, as we trough and move into expansion again we want to shift into longer-term corporate debt.

For illustrative purposes only

In traditional mandates, the portfolio manager has limited flexibility to adapt and change. If a mandate is tasked with managing Canadian government bonds that is what they will do regardless of their market outlook.

The Marret team uses the flexibility of the liquid alternative structure to hold the types of fixed income securities they see as most opportune for the time. Specifically, as we entered 2020 they believed we were in the late expansion phase of the business cycle and held 100% in government bonds and cash. In April, however, they believed that we may be hitting the trough of the recession and started dipping their toes into the corporate bond market.

The idea is to give the portfolio management team the flexibility to fully express their ideas.

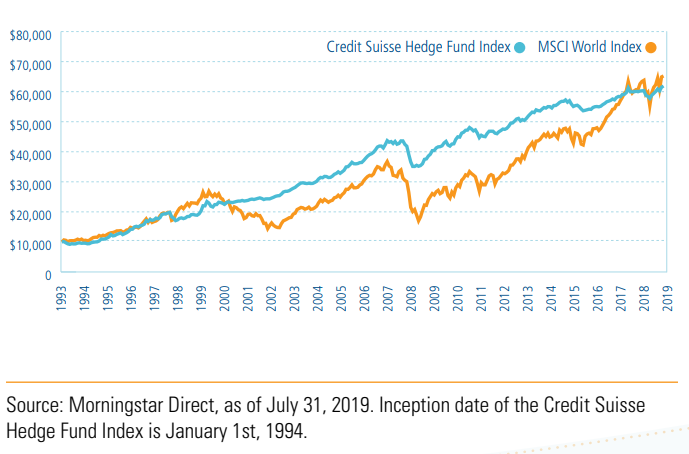

Since their launch I have come to 3 core conclusions.

- Many have proven themselves stable and resilient during the recent volatility

- You want to entrust a portfolio management team with alternative investment or hedge fund experience

- Liquid alternatives can act as a compliment to your existing investment

For illustrative purposes only

How do I see these being incorporated into your portfolio?

Again, liquid alternative can act as a compliment not as a complete replacement to your existing investment components. And the allocation should be measured.

Suppose your current portfolio is split between real estate, income and equities perhaps 10%-30% gets allocated to liquid alternatives.

I think adding liquid alternatives will make the tough times more tolerable which gives us a better opportunity to achieve our long-term rate of return objective.

As always give me a call if you have any questions.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Liquid Alternative investment funds have the ability to invest in asset classes or use investment strategies that are not permitted for conventional mutual funds. The specific strategies that differentiate these investment funds from conventional fund structure include: increased use of derivatives for hedging and non-hedging purposes; increased ability to sell securities short; and the ability to borrow cash to use for investment purposes. While these strategies will be used in accordance with the investments funds’ investment objectives and strategies, during certain market conditions they may accelerate the pace at which your investment decreases in value. Please read the Fund Facts and consult your Assante Advisor before investing.

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.