Investing With Tax in Mind

We all live off net or after-tax income. It is what rests in our wallets and purses that pays the bills and puts food in our bellies. Ok – that makes sense but is there a way to structure our investments to maximize our net result? The quick answer: absolutely.

We need to consider that:

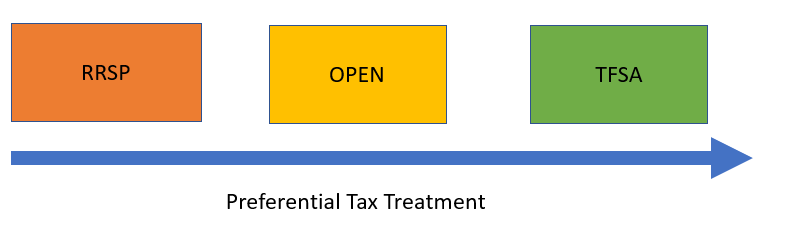

- The main plan types - RRSP, OPEN and TFSA accounts have different tax treatments

Withdrawals from an RRSP are fully taxable while withdrawals from a TFSA are not taxed at all. The growth inside a RRSP and TFSA is tax-free. In an OPEN plan realized income (interest, dividends and capital gains) is paid in the year received and unrealized gains are paid on disposition.

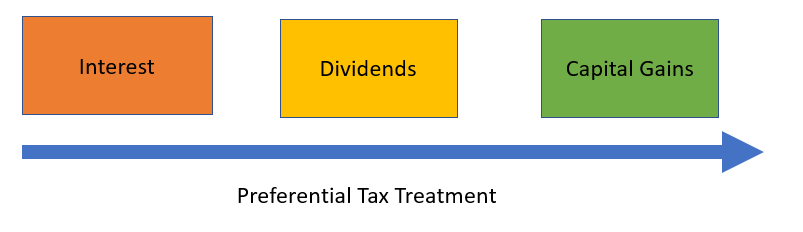

- Different types of income are taxed differently

Interest is fully taxable like income; capital gains are only half taxed and Canadian Dividends fall in the middle as they have a gross-up and tax credit component.

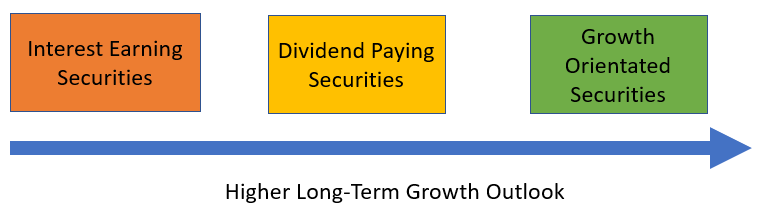

- Different types of investments have different long-term return prospects

Different types of investments have different long-term return profiles. We expect bonds to be steady but low growth while expecting equities, particularly emerging market and small-cap equities, to have a high long-term growth potential. Companies paying dividends are typically more mature in nature and have more modest growth prospects.

In terms of plan type:

In terms of income type:

In terms of long-term growth potential:

The Strategy

To maximize our after-tax results, we should structure our plan types, investments and income types to match the colours as best possible. Preferably, we want our high-tax low-growth bonds in our RRSPs and high-growth securities in our TFSA. The remaining sums would spill into the OPEN plan. We would prefer an investment with the potential to double in our TFSA paying no tax versus an RRSP which would be fully taxed.

For Example:

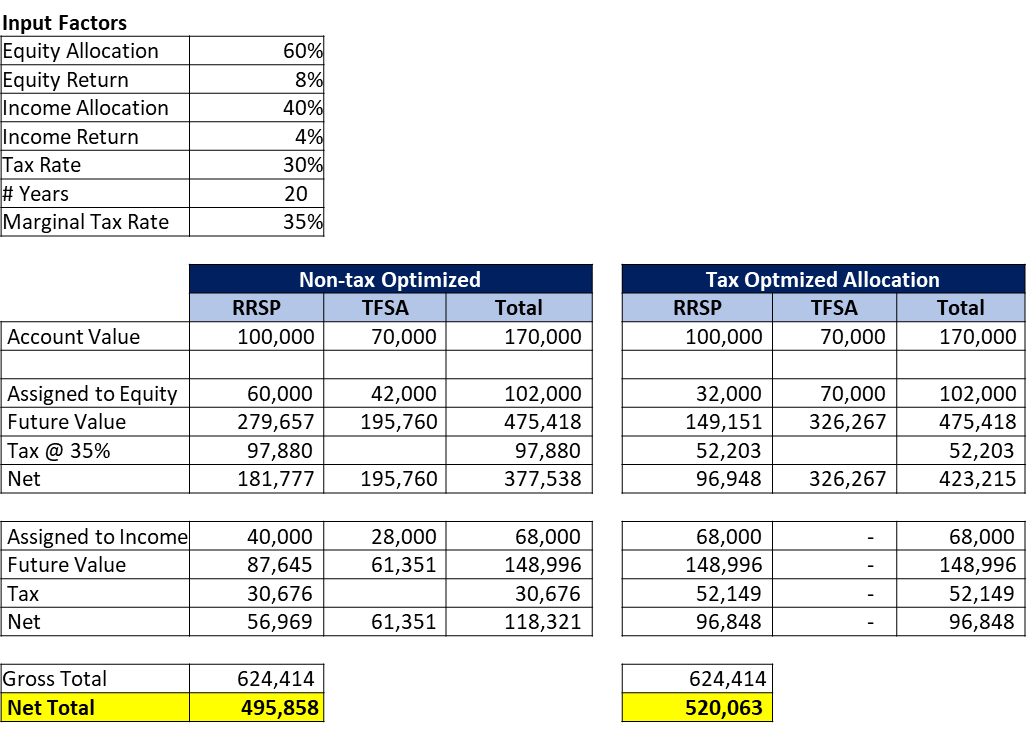

Suppose you had a 60% equity and 40% income portfolio with $70,000 in your TFSA and $100,000 in your RRSP. In this world, equities earn 8% while the interest income earns 4% over the long-term.

- Non-tax Optimized: If you had held the same asset mix in both the RRSP and TFSA - meaning a 60% equity / 40% income portfolio in your RRSP and 60% equity / 40% income portfolio in your TFSA. After 20 years, your ending value would be $624,414. After taxes are paid you would have $495,858 in your pocket.

- Tax Optimized: Alternatively, suppose you tax-optimized the portfolio so that high-growth equity investments resided in the tax-preferred TFSA while the RRSP held the majority of the low-growth high taxed income. In this situation the overall portfolio value is the same at $624,414 but the after-tax value would be $520.063.

Tax optimization added 5% to your net after-tax return without assuming any more risk. Seemingly small adjustments like tax optimization collectively add tremendous value to your portfolio and to your financial goals. It is unfortunate, that Canadians tend to use the TFSA to house their low growth interest paying investments (think GICs and high-interest accounts) while their equities lie in their RRSPs. I’ll continue to share these ‘small adjustments’ in upcoming newsletters.

The tax optimization methodology is applied in the Evolution and Private Client programs that many of you hold. If you would like to learn more, please let me know.

The above table is for illustrative purposes only.

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.