Genius or Incompetent: It Depends on Timing

The effect of start date bias can distort our sense of equilibrium in investing. As it implies, start date bias is the effect of timing on your rate of return results. In the short-term, this effect can exaggerate our confidence, or lack of confidence, we have in our portfolio, financial plan and financial professional at our side.

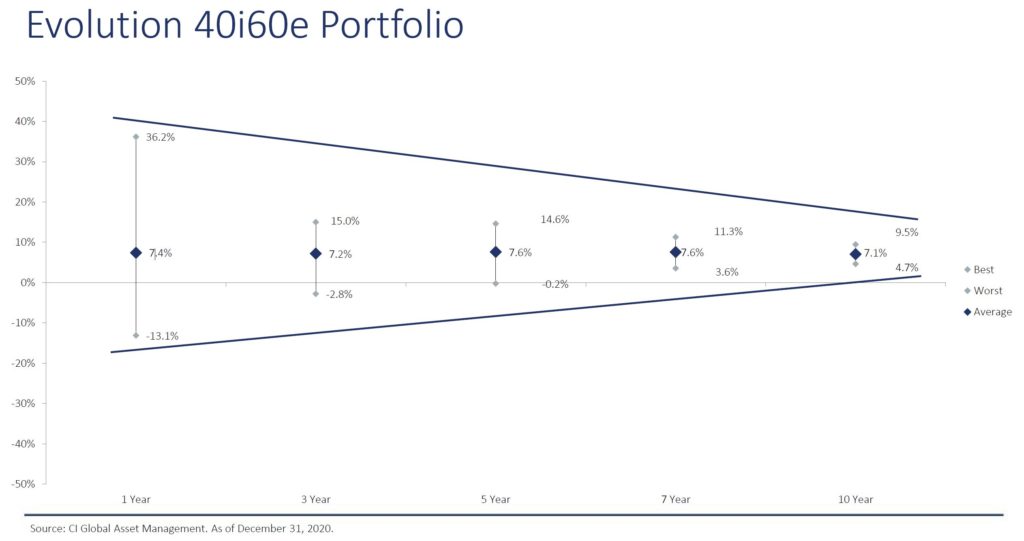

Let me compare two scenarios using actual performance data from an investment program called Assante Private Portfolios (formerly Evolution Private Managed Accounts) and their 40% Income / 60% Equity portfolio mix. The Assante Private Portfolios program has been around for almost 14 years, so we have quite a bit of history to lean on.

For this discussion, I’ll be using the term month-by-month rolling returns. This is much more insightful compared to simply calendar year returns. For example, 1-year rolling returns means that we look at how the portfolio did from May 2008 to May 2009, June 2008 to June 2009 all the way to December 2019 to December 2020. So, there would be 12 data points for the first year of performance and 60 for the first five years.

When we look at the 1-year month-by-month rolling returns since the Assante Private Portfolios program was launched, we can start to see the effect of start date bias. While the average one-year rate of return experience was a comfortable 7.4% the variability of the returns making up that average were all over the map. If you started at the most opportune time you would have experience a 36.2% upswing in the first 12-month while if you commenced at the most inopportune time, the one-year experience would be -13.2%.

To one client, I am a genius – to another I am bordering on incompetent. Same investment solution – drastically difference experiences; in the short term.

What is interesting is how the extremes and average manifest over time.

The 3-year rolling average experience stays about the same as the 1-year number at 7.2%. Remarkably, the extremes narrow. The best performing period drops to 15.0% while the weakest rises to -2.8%. If we carry on and review the 5-year, 7-year and 10-year results we observe that the extremes further narrow while the average stays relatively constant.

Now, let’s zero in on the 10-year. Certainly, we would all like to experience the optimal 9.5% annual 10-year rate of return. The trouble is that we do not have a working crystal ball to tell us when to ‘start’. And, if we did we may need to wait years for that moment to occur. What give me great confidence is that the poorest 10-year result, (which means you started in the program at the worst possible month) still had a positive annual return of 4.7% which is not far off the 4-5% assumptions I use in most financial plans.

In fact, the investment management team at CI GAM | Multi-Asset Management aims to deliver 5.8% for their 40% Income / 60% Equity portfolio if you hold it for their prescribed 8-years. To date, they have been able to meet this objective in 96% of scenarios.[1]

What do we take from this? Well, a few things.

- First and most importantly, we cannot time the market and predict whether it will go up or down in the coming few months or year. As financial guru Nick Murray once said: “I don’t know the direction of the next 1,000 points but I do know in the direct of the next 10,000 points; and that is up.”

- It is crucial that we invest according to our time horizon. I think of one client that received a large payout from their employer and knew they would face a large tax bill in 12 months. Those funds destined for the tax liability were not invested alongside their other investments. Imagine if we stepped on the wrong sequence.

- If you are going to compare one investment against another make sure you are comparing the same time periods. One month can make a huge difference. Moreover, don’t put too much weight into ‘since inception’ rate of return figures since those are plagued by start date bias. Imagine, the world’s great investment was launched the day before the decline of the Great Financial Crisis. Those numbers would look terrible for years despite them being inherently superior.

The investment actions that we embark on together can only be judged over a long period of time. This takes faith and a fortitude to stare down fear at times. It is not easy, and I am continually encouraged by so many of my clients that have stayed focused and achieved their financial objectives.

As always give me a call if you have any questions.

[1] (Source: Assante Private Portfolios Performance Report – March 2021)

This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see a professional advisor for individual financial advice based on your personal circumstances. Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada.

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.