Do Opposites Attract? Negative Sentiment & Performance

How are you feeling about the world these days? How do you see our collective prospects? I don’t think it would be a stretch to imagine that you’ve tipped negative in your outlook. We all know the causes. Even my 9-year-old son, Julien, can rhyme them off.

Listing the causes is one thing. Seeing a way out is another and it is hard to see how we will exit this chapter. We will. We always do.

Consumer sentiment, or our collective mood, shifts over time like a sine curve. We cycle from confidence to pessimism back to confidence again returning to pessimism over time. Our outlook can change drastically over a month or two or sometimes it can take a few years to bring us you into a new state of thinking. And not all high and low periods are that of hyper exuberance or extreme cynicism. There are periods of moderation. Our collective sentiment comprises of all our unique perspectives – so we, as individuals, may differ from the current zeitgeist.

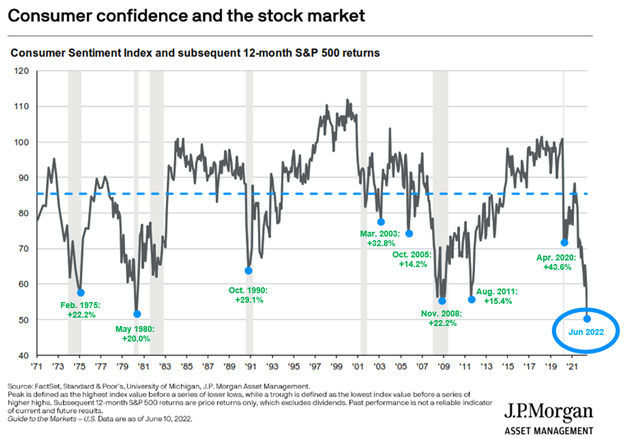

The chart below shows you the U.S. Consumer Sentiment, the American mood, over the last 50 years – since 1971. Despite being a little more jagged – it does follow the pattern of a sine curve. The reasons and causes of why we shift from optimism to pessimism are unique to each period. In the early 70s it was the OPEC induced oil shock. In the late 70s / early 80s it was inflation. While the tech bubble bursting and the 9/11 terrorist attacks bought our collective confidence down in the early 2000s.

Where are we today? Well, we are at the lowest point of consumer sentiment on record. That, at least, confirms what we’ve all been feeling. It also suggests, to me, that we may be reaching the trough of our emotions – on the eve of more optimistic days.

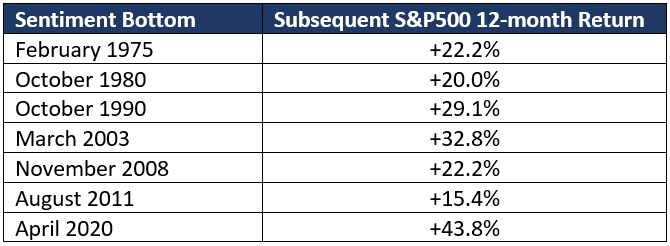

What are the prospects for our investments at points of pessimism? Is sentiment a good predictor? As Warren Buffet famously said: “Be greedy when people are fearful.” Let’s see and have a look at how the S&P500 performed 12-months after the bottom of the consumer sentiment cycle.

Is mood a good predictor of performance? The evidence of the last 50 years tells us that – yes – negative sentiment is a good predictor of positive future returns. Today, we are at the lowest point of consumer sentiment over the last 50 years. We still may go down further but history suggests that forward looking returns look promising.

At the minimum, now is not the time to make radical changes to your plan.

I hope you are all well and if you have any questions about your portfolio or financial plan please give me a call.

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.