Dead or Inactive - The Optimal Investment Strategy

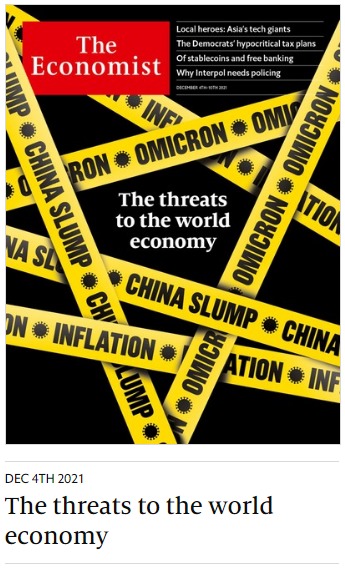

Unless your home team wins the championship, headlines are typically negative. This helps capture and keep our eyeballs glued to our screens. We know this. What’s remarkable (to me) is how quickly the media moves from one crisis to the next.

Over the last six months, for example, we’ve shuffled from the Covid crisis to the Russian aggression crisis and now to the cost-of-living crisis. I’m not suggesting that these events aren’t real or impactful on people. I’m suggesting that we don’t get a day off and that we are rarely informed about how we successfully exited previous challenges.

Today, the bubbling crisis seems to be that of the coming recession. Will there be a recession in the future? Absolutely. Will it begin in 6, 12 or 24 months? Or, in 5 years? I don’t know the timing - nor does anyone else with complete certainty. For your portfolio, equity markets tend to retrench when a recession is on the horizon and climb when expansion is within sight. The formula seems straightforward and easy to take advantage of.

Unfortunately, no one has successfully predicted the start and end of recessions in any consistent manner. That’s why financial commentators generally assign a probability like a 27% chance of recession in the next 12 months.

And, supposing someone could make that prediction - they would then need to determine when the markets would react negatively to the coming recession and positively react to the pending expansion. That’s two dimensions of extreme complexity – overlapping each other. Bonne chance.

I often cite examples of how trying to time the market leads to poor results. I stumbled on a gem the other day. Fidelity conducted an analysis of their clients to determine what sub-group had the best performance between 2003 and 2013. They learned that those with the best returns were "either dead or inactive." That’s right: “Dead or inactive” (From the Archives: In Praise of the Dead (Investors) | Morningstar).What do these two groups have in common: they don’t react to today’s panic or hype.

Your portfolio is not on autopilot. Your portfolio managers are making proactive changes behind the scenes. Perhaps, they are holding more cash than usual. Perhaps, they’ve exited or entered certain sectors or geographies. Maybe, they’ve purchased some amount of portfolio insurance (put options). Their intention is to make any downside less severe rather than avoid the recession bogie entirely. Why not try and avoid it? They know that the odds are against them when the US economy grows 85% of the time and markets rise 3 of 4 years . It does not make sense to fight the gravitational pull upwards.

I am encouraged that you all exemplify these positive investing traits while still being alive and active!

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioural disciple that are likely to get you where you need to go.”

- Benjamin Graham, Warren Buffet’s mentor.

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.