Covid-19: Dealing with Today's Down Markets

Hello everyone,

First, thank you to everyone who reached out to see if my family and I returned home safely. We did and are sitting comfortably at home in self-isolation. You may be hunkering down. You may be working. I hope you are well.

The dial on turbulence continues to be turned up. We all read about the virus hitting China then Europe weeks and months ago, but it only hit our collective consciousness when it began expanding in earnest on our shores a few weeks ago. These are scary and unsettling times. I wanted to provide some thoughts, perspectives and actions you may want to think about.

You Have a Plan

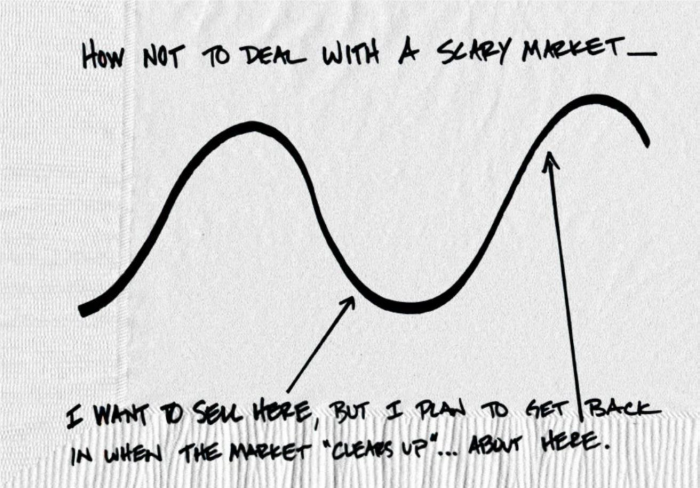

You have plan with a portfolio that was built specifically and intentionally to give you the greatest likelihood of reaching your goals. And, yes, your portfolio is down and you may want to sell it all and move to cash because that feels safest. That may feel the most comfortable, but history tells us that this is the exact move that will impair your long-term investment and financial objectives.

We didn’t specifically build your portfolio for the Covid-19 virus in mind, but it was designed around volatility and the ability to recover. We have been to these places before.

Perspective

We are in the eye of the storm right now and it is tough to see five feet away. It seems that every piece of news or social media talk to our current predicament. It is relevant and we are interested. But we should also be looking at what is on the horizon and what has happened historically. If we consider that China was ground zero for the pandemic, we can also witness that deaths have plateaued, the economy has stabilized and activity in Wuhan is resuming. Is this a foreshadowing of what is to come for us in a few months? Perhaps. We can’t know for certain but it does provide a tangible sketch.

If you have 11 minutes, I would also invite you to watch economist Brian Wesbury of First Trust who provides some historical context around flu pandemics and reminds us that markets are forward looking.

Flus have happened before, yet they are not in the collective zeitgeist. Consider flus such as of the Asian Flu (1957–1958) which killed 1-4 million people worldwide and 116,000 in the US and the Hong Kong Flu (1968–1969) which killed 1 million people worldwide and 33,800 in the US. These came at a terrible loss of life, but we endured, and economies recovered and expanded. Today, we have better communication tools, more advanced health systems and more national and global coordination.

We also must remember that markets anticipate what will happen in the future versus react to what is happening on the ground. For instance, North American markets started to decline in February when the virus really debuted in our geography – not when the unemployment numbers spiked. Markets recover when they see that things will improve – not when they improve.

Let’s look to the financial crisis as an example. Markets bottomed and begun recovering March 2009. The real economy, however, saw the first month of job gains in November 2009 and consistent job growth in the fall of 2010. When the environment looked and felt stable significant market gains had already taken place.

What you can do

Determining what you can do depends on your situation.

For retirees drawing on their savings, consider looking at your budget to see if you can reduce your withdrawals. Keeping more in the portfolio would allow for a greater recovery.

If you are currently contributing and feel that a layoff or salary reduction is near, you may want to consider pausing your contributions. We hate to do this but a few extra dollars in your bank account may be prudent. Also, review the new government measures put in place to help you financially.

If you have the time horizon and risk appetite, it may be time to consider looking at these events as an opportunity. Do you have extra cash? Should we increase the equity content of your portfolio?

Mostly, stick with your plan and know that we will exit this period and look back on it in disbelief.

Feel free to reach out if you have any questions bdeviney@assante.com – 416.216.6500.

Be well,

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.