Coronavirus Update

Coronavirus Update

In the recent days and weeks, we have seen the coronavirus spread outside of China in a more pronounced way affecting financial markets around the globe. The decline of stock markets is related to the belief that the virus will have a meaningful impact on supply chains and global demand. Meaning, the delivery of iPhones will be delayed, people will defer vacations and watch Netflix instead of going to the movies. This, in turn, will translate into lower GDP and lower company earnings. Markets do not like uncertainty and today we have little insight on when this may end. As of Friday, February 27th, we have seen the S&P500 and MSCI World indexes decline by over 12% from their peaks.

We have seen multiple drawdowns in the financial markets since the financial crisis, but they may have felt more distant. Most were driven by influences in the economic sphere. Consider the series of interest rate increases in 2018 which led to a S&P500 decline of 19.6%. Or, in 2011, when the US credit rating was lowered from AAA to AA+ and equities dropped by 7% in one day. Unlike these examples, the Corona virus creeps into the personal - our day-to-day. We see people wearing masks. We hear about added procedures in hospitals. The media updates us on the number infected on the hour. And, we may be becoming nervous about our vacation plans. Because of the personal link I think we are more aware of the financial dimension.

Certainly, portfolios have dropped but let’s bring in some context. Most of you are in balanced portfolios. You have a sleeve of income alongside your equity holdings. A balanced portfolio has experienced a more softened decline. Using the Evolution 40% Income / 60% Equity portfolio as a proxy we can see that it declined by 6.5% from its peak. Much less than the broader markets. Moreover, since the beginning of the year, the Evolution portfolio had declined by 3.3%. To me, that feels much more tolerable than the fear being discussed in the media.

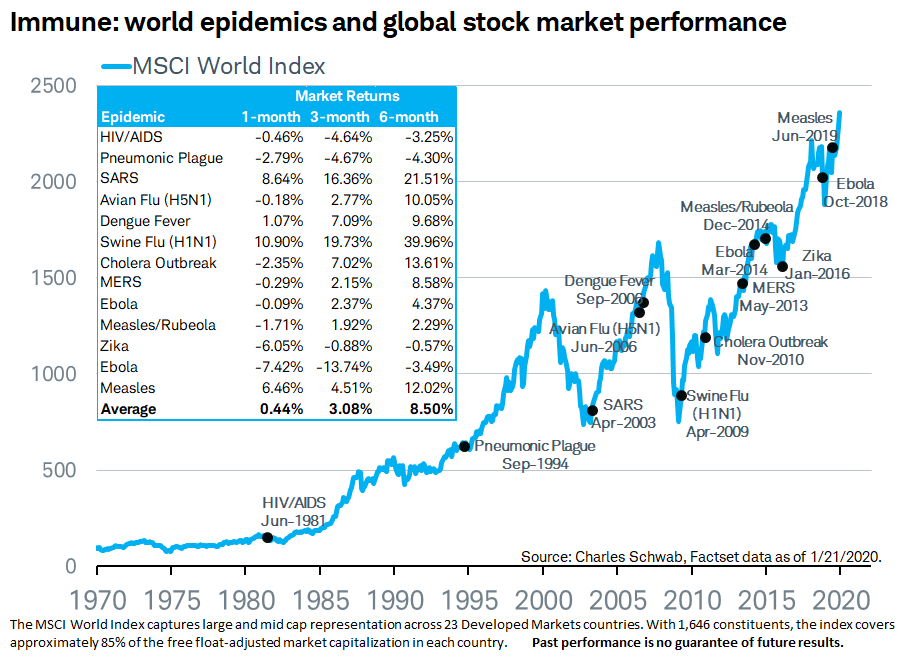

I do not know how far the outbreak will spread before being contained or how many lives it will take in its course. I am confident that the world’s leading virologists and epidemiologists are working on it, and I believe that their efforts will ultimately succeed. If the rich history of similar outbreaks in this century is any guide, this would seem to be a reasonable hypothesis.

This too will pass.

If you would like to discuss further, please feel free to give me a call.

![]()

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.