Tariffs 2.0: Thoughts

It’s no exaggeration to say that discussions around Trump and tariffs have eclipsed even the weather and real estate. Every morning, as I check Bloomberg, I find the landscape of tariffs shifting—new tariffs, delays, exemptions, and retaliations—creating a roller coaster of uncertainty that leaves us, as investors and Canadians, feeling like we’re bracing for a quadruple inverted triple flip, rather than enjoying a leisurely merry-go-round.

Another Year, Another Crisis

We find ourselves in another episode of unsettling uncertainty that investors have come to know well. During such periods, the urge to take action—to alleviate anxiety—often emerges. However, enduring and accepting this uncertainty is the price we pay for above GIC rates of return. In recent years, we have navigated through significant events: Brexit, Trade Wars & Tariffs 1.0, COVID-19, negative oil prices, fluctuating interest rates and wars in the Middle East and Europe. These events have introduced volatility, yet our portfolios have grown to new heights. Now, we face the unfolding Trade Wars and Tariffs 2.0 saga.

Putting Tariffs in Context for the U.S.

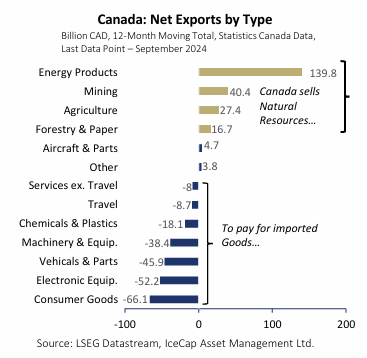

Some proponents suggest that tariffs will incentivise companies to reshore production to the U.S. but in Canada’s context we export oil, rocks and trees and we import value added products from them – and – you can’t reshore a mine or a forest.

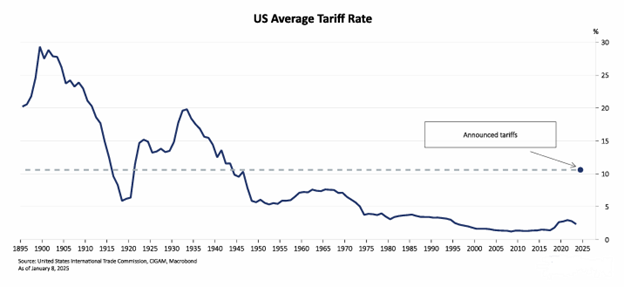

For the U.S. economy, tariffs will drive higher prices on over 40% of imported goods in the U.S., affecting approximately $1.3 trillion worth of goods – significantly more than the $350 billion in imports during Trump’s first term. The US average tariff rate on goods imports would increase to roughly 11%, the highest level since the early 1940s. Early estimates suggest a -0.5% to -1% hit to U.S. GDP, while inflation is likely to increase by around +0.5% to +1.0%, relative to the baseline forecasts (Capital Insight, February 3rd 2025). These proposed tariff increases represent a significant shift, and if fully implemented, will put a stick in the spokes of the U.S. economy.

Tariffs are an excellent example of a political policy that is superficially appealing to people who don’t know much about the issue, but are always bad policy. That’s why it took so much effort to get rid of so many tariffs in the Free Trade Agreement in 1988, yet it has been a good thing for both sides.

Yogi Berra famously quipped that “predictions are difficult, especially about the future.” This resonates deeply in the world of finance, where uncertainty reigns supreme. The truth is, we don’t make forecasts. We, like everyone else, know very little about the future. Investing may seem like a precise science of numbers, but it’s actually driven by ever-changing psychology, irrationality, and randomness – a randomness far more complex than a simple dice roll.

This is a good moment to reiterate several of our bedrock principles.

Bedrock Principles

#1: Resilience: We – in the West, so far, at any rate – deal with our problems, and move on. The economic, political, and financial crises that seem so intractable today are somehow dealt with over time, and take their place in history.

We’ve been doing it for about 400 years since the advent in Holland of individual liberty protected by rule of law allowed human enterprise to flourish, and increased our standard of living by about 300-fold.

#2 Forecasting is Unnecessary: Not only is forecasting market fluctuations a waste of time, it is totally unnecessary. Which is why we don’t do it. Markets go up three years out of four. No reason why that won’t continue. Betting against 75% odds is unintelligent.

#3 Inevitability of Declines: Markets also go down every year, at some point. The average intra-year decline is a little over 14% for the S&P500. So, from some point in the year to a lower point in that same year the market is on average 14% lower (JP Morgan). No reason why that won’t continue either. Trying to avoid something that happens every year is unintelligent.

#4 Declines Are Unavoidable: These declines can indeed be scary. But trying to trade out to avoid them is not possible. The most successful investors don’t even try.

#5 Long-term Gains: As we’ve just witnessed, with our own eyes these past 5 years, the S&P500 has more than doubled from its Covid lows. More importantly, it has almost doubled from the pre-Covid peak in 2019.

That is the most important lesson: even from the ‘worst’ time – immediately before a significant decline – and five years later that episode, as scary as it was at the time, is already taking its place in the mists of history. This is why, as Nick Murray says, ‘The declines are temporary, the advances become permanent’.

All this is to say that I’m not running for the hills. That being said, if you have a significant expense in the near future, such as a car purchase, renovation or once in a lifetime trip, set those funds aside in cash.

Conclusion: Embrace Uncertainty

As we navigate the complexities of 2025, let us remember the limitations of trying to predict the future and the importance of adopting a balanced, long-term perspective. The reality is that markets are unpredictable and influenced by hundreds if not thousands of factors, both rational and irrational. By setting our sails wisely, embracing uncertainty, and overriding our instincts for greed and fear, we can put ourselves in the best position to achieve our financial goals regardless of the current day’s panic and worry.

Bryan Deviney is a Senior Financial Advisor with Assante Capital Management Ltd. The opinions expressed are those of the author and not necessarily those of Assante Capital Management Ltd. Please contact him at 416.216.6500 or visit www.bryandeviney.com to discuss your particular circumstances prior to acting on the information above. Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization.

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.