Last Year’s Market Volatility

For 2018, Turbulent was an understatement

After an unusually calm year of solid performance for capital markets in 2017, investors experienced a much bumpier ride in 2018. Markets stumbled in the first quarter, and though they moved generally higher through the summer months, a sharp sell-off in the fourth quarter meant that most asset classes registered negative returns for the year. Not even the high-flying FAANGs (Facebook, Apple, Amazon and Netflix) could escape the negative pressure. Even the harbour of defense – fixed income – felt negative headwinds.

There were two primary items that raise anxiety for investors.

a) Fear of further rate increases in the Unites States. In 2018, Jerome Powell chair of the Fed seemed dogmatic in his view to raise interest rate in 2019. This was concerning to some as the previous increases had already caused disruption in global markets as they recalibrated. He has since toned down his language and said the central bank will be “patient” in its approach to monetary policy. “There is no preset path” for raising rates or adjusting the balance sheet. This is positive and has helped calm markets.

b) Trade tensions. Increasing trade friction between the U.S. and its trading partners, particularly China, and the fraught Brexit negotiations between the U.K and the European Union added uncertainty. Expanding global trade has been the centre of rising global living standards for decades. The Trump administration’s seeming intolerance of trade threatens the feeling that agreements will be reached. Sometimes it can be hard to separate reality from the rhetoric. Yes – China and the US are in a strong dialogue but like the Korean, Canadian / Mexican and European examples, in my opinion, a deal will be struck.

Financial markets tend to overshoot on the upside; and on the downside. In the long-run, markets get it right, but we must go through the ups and downs to get there. We must remember that the economy is not the same as the financial markets and the financial markets are not the economy.

Some perspective on the bumpy ride

Pundits, including me, can go on and on about the causes of market turbulence but it does not take away from the unsettling feeling that may arise when you see your statement or see the day’s market decline. The reality, however, is that market volatility is normal.

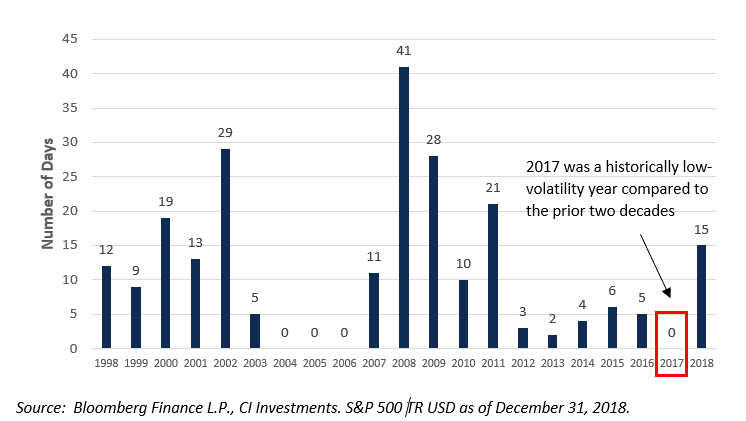

The chart below shows that in most years, the S&P 500 will experience several days in which the value of the index drops by 2% or more. In this context, 2017 was an outlier with nearly non-existent volatility. Last year, with 15 days registering losses of 2% or more, the level of volatility for the index returned to a more “normal” range.

Downside volatility is normal

The number of days the S&P 500 fell by -2% or more:

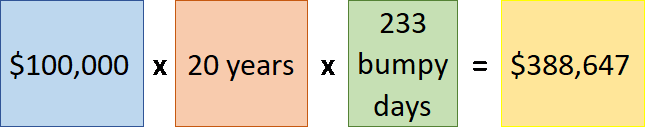

Had you invested $100,000 at the beginning of 1998 and weathered the 233 days of -2% performance from 1998 to 2018 your investment would have grown to $388,647 today. It pays to ride the volatility out.

It is nearly impossible to predict when market swings will occur. Studies have shown that investors who attempt to time the market – that is, sell before a downturn and reinvest when markets are poised to rise – often end up missing the best upside days and underperform relative to those who stay invested. Markets do not advance in a straight line, but historically the long-term direction for equities has been up.

Where to go from here

It can be difficult to maintain a long-term perspective when negative headlines dominate as they have in recent weeks. But, are there any actions that should be considered? Here are three to think about:

a) Review your financial plan. Let’s sit down and see how the recent volatility has affected the long-term sustainability of your financial health.

b) Check in on your risk tolerance, risk capacity and risk required. I’ve been working with a third-party firm, FinaMetrica, to better gauge your risk levels to make sure we have it right. Ask me to run you through the process.

c) Be opportunistic. As Warren Buffet is famously quoted: “Be fearful when others are greedy and greedy when others are fearful.” For those with the right time horizon and financial position this may be a fantastic time to be ‘greedy’. This could look like:

-increasing your equity exposure up a notch, say from 60% to 70%,

-making your TFSA contribution today or

-investing the cash that has collected in your chequing account.

I believe the most important action to take as an investor is to create a sound, diversified investment plan that takes your time horizon and risk levels into account. Having this context better allows you to ride out any short-term market turbulence.

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.