Putting Today's Market Decline in Context

For many it can feel that we are always in an investment hole. Trying only to recoup where we were only a month or two prior. Unbelievably, it was only 2 years ago that we felt the fastest 30% drop in U.S. equities on record. Then the antagonist was a virus. Today, it is stubborn inflation, rising interest rates and an unstable geopolitical environment.

The reality is that this is the norm. Sudden declines are normal part of the market cycle and are a magnifier of collective fear. When the broad market, say the S&P500, goes down by 10% or 20% does that imply that the economy is going to contract by 10-20%. Or, that company earnings will be impaired by 10-20%; permanently.

The profound recession caused by the Great Financial Crisis lasted 1 ½ years and saw the US economy decline by 5.1%. Absolutely, company earnings collapsed for some time and the mood was dire. However, measures were put in place to stabilize the financial system which allowed the economy to heal. In retrospect the 49% decline of the S&P500 was an accurate gauge of the mood but an overly negative view of the future.

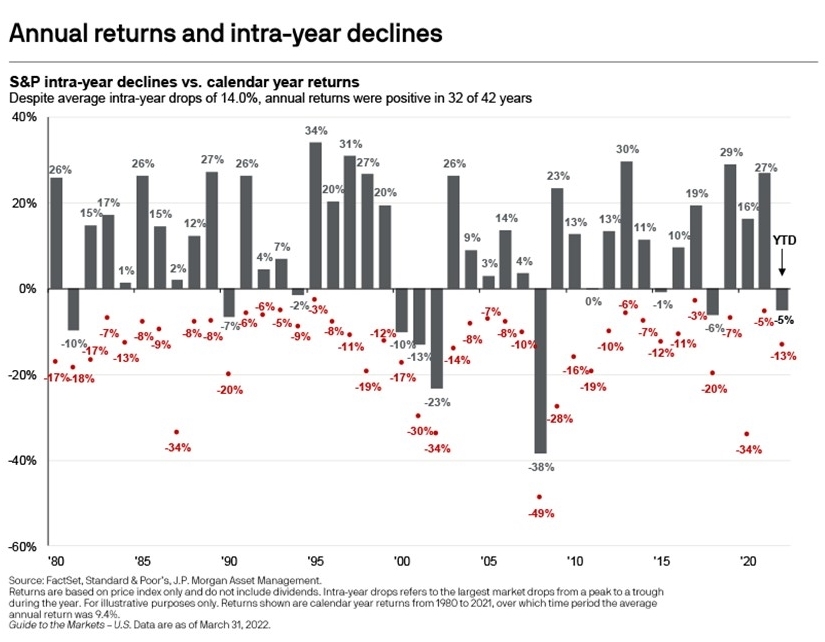

The chart below shows the annual performance of the S&P500, the broad U.S. stock market, since 1980. In 1981, the annual performance was -10% while in 2013 it was +30%. During this 40+ year period, the S&P500 had an annual return of 9.4%.

This period includes multiple wars, a global pandemic along with multiple debt, financial and currency crises. Some good was also achieved with absolute poverty being almost extinguished across the globe seeing a decline of 1.92 billion to 733 million people and relative reduction of 43% to 10% of the world’s population. https://ourworldindata.org/grapher/world-population-in-extreme-poverty-absolute

You’ll note that the S&P500 had positive returns in 32 of 42 years. So, for every 3 years of advancement you could expect 1 year of retrenchment. The chart makes it seem like a benign journey with only a few interruptions along the way. This would be the case if we checked our balance on December 31st and then went into a year-long hibernation. The reality is that we live day-to-day in the real world with all its complexities.

When we look below the surface we get a better appreciation of how each year goes through its own cycle. While the grey bars show how the S&P performed over an entire year the red dot tells you the largest decline that took place during the same period.

If we look at 1987, the year of Black Monday, the market went down 34% at one point but ended the year with a positive 2% gain. Or, in 1980 when the market rose by 26% it was down -17% at one point. The journey is a little more rough than was originally presented.

On average, the S&P500 sees a 14% decline each year. You could say that most years have their own bear, or mini-bear, market. Most of the time we tend not to notice because it recovers before the next statement comes out or the crisis du jour does not make it to the mainstream media.

Why do so many agonize around these otherwise ordinary rhymes. Should investors not be more accustomed to them? Certainly, the media doesn’t help by trumpeting the world’s problems and divisions, but I think the cognitive bias called anchoring that is also at work.

In the realm of investing, anchoring skews us to believe that the highest portfolio value that we’ve achieved is the one we ought to have – dare I say: deserve to have. As our portfolio grows from $750,000 to $800,000 to $850,000 a mental ratchet locks these values in place. Our hard wiring leads us to believe that this value should not come down.

I believe we’ll see the anchoring effect play out in GTA real estate in the coming months. If your neighbour’s home was worth $1 million in June of 2021 then rose to $1.3 million January 2022 but quickly retreated to $1.1 million when interest rates rose in this spring - did they lose money? Are they down?

Perhaps, more importantly, is how they perceive they position. It is only human be hold on to the $1.3 million value – the highest value.

I’m not trying to gloss over the stress that these episodes cause. As I write this on May 11th, the S&P500 is down almost 16% year-to-date on the year. Compared to previous intra-year declines it is not the softest nor the most striking.

Like the ones before it, this retrenchment has a new storyline and a new set of villains. During times like these we need to stick to our plan and not forget how we endured, and rose from, previous tough times. The truth is that to earn more than a GIC rate, we must bear volatility.

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.