3 Overlooked Aspects to Financial Planning

There are important dimensions to a retirement income plan that people often overlook. These oversights may put people in financial harm’s way. Below are 3 planning aspects that aren’t usually considered.

Meet Alan & Dawn

Throughout this discussion I’ll be referring to a fictitious client couple called Alan and Dawn.

They:

- are both 65 and recently retired,

- receive full CPP and OAS,

- have $1,000,000 saved in RRSPs and

- require $75,000 / year after-tax.

Does Retirement Mean De-risking?

“We’re retired now. We should have more bonds -right?” I often hear people asking me if they should be decreasing their equity exposure in favour of bonds or GICs as they enter retirement. I can understand where they are coming from. The media saturates us with sound bites that our equity allocation should be 1 less our age. From an emotional point view, I can also sympathize. You’ve spent 30 plus years working and saving and the thought of going through another market decline seems exhausting. The trouble is that, for most, not having a healthy allocation to equity can spell certain disaster.

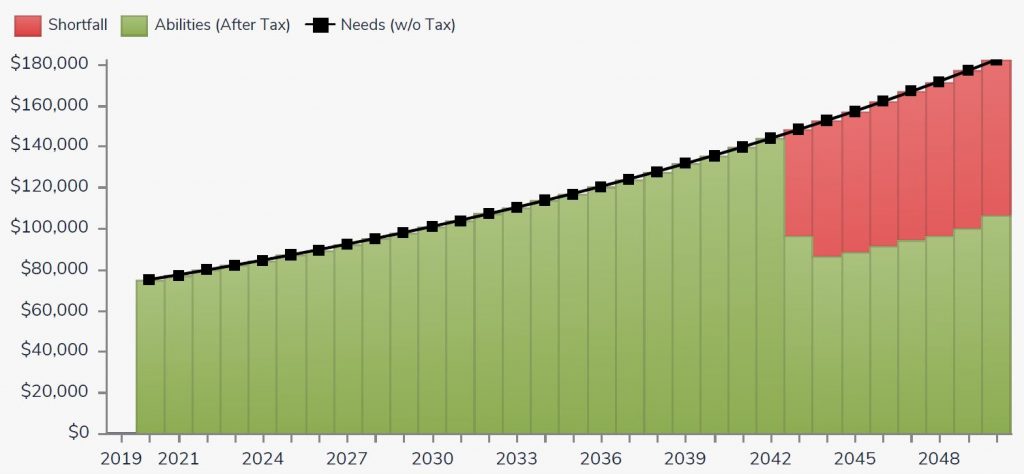

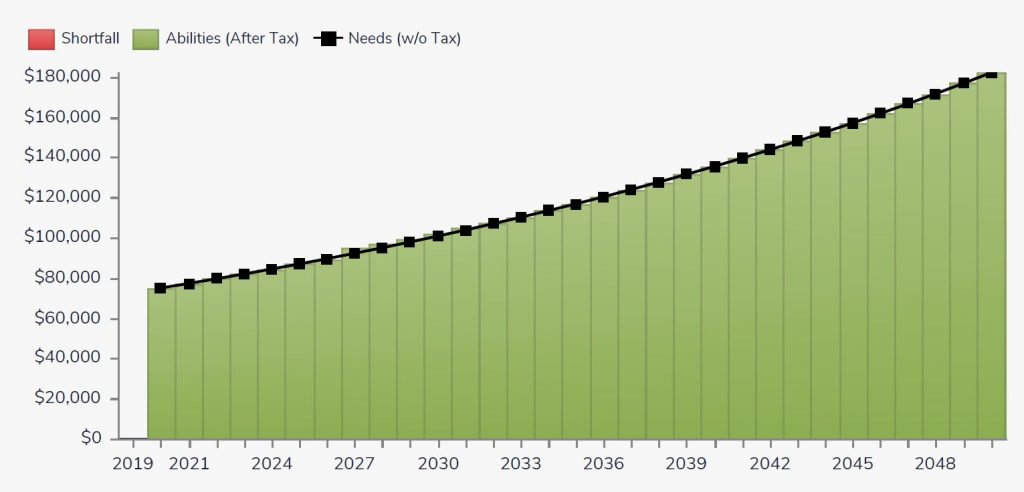

For Alan and Dawn moving to a GIC portfolio earning 2.5% would ensure that their savings ran out at age 88 instead of 95 if they had earned 5% with a balanced portfolio.

Illustration demonstrating shortfall at the age of 88 if invested in a portfolio earning 2.5%

Illustration showing full funding until the age of 95 if invested in a portfolio earning 5%.

Not Considering the Financial Impact of a Premature Death

Retirement income plans can be viable when both spouses are alive but can be precarious when one dies. From a financial point of view a few things happen when one passes away.

- The Old Age Security (OAS) stop,

- Only a portion (if any) of the Canadian Pension Plan (CPP) transfers over and

- A defined benefit pensions may be reduced by 30-50%.

- On top of that, as a single person the survivor no longer qualifies for pension income splitting. This means that they will need to pay more income tax to generate the same after-tax income.

Supposing that Alan or Dawn suddenly died. They would need over $500,000 above their RRSP savings to make up for lost OAS and CPP income along with the higher tax bill to keep the survivor at the same standard of living.

Using Linear Assumptions in an Unpredictable World

Using a flat or linear rate of return is powerful is demonstrating whether your financial goals and objectives are you on-track or off-track? It fails, however, to incorporate the variability of returns. Earning 5% does not always come with a smooth ride. There are down years, flat ones and, yes, positive ones as well. Landing on flat or negative returns at the beginning of your retirement can put you in financial peril. It is important to stress test your plan against the variability of returns. We do this using a Monte Carlo analysis which tests your plan against 500 scenarios. The result gives us a sense of the strength of your plan to weather unpredictability.

For Alan and Dawn we find that when stressed tested in 88% of scenarios they end up with over 90% of their targeted income. This compares to the 100% success with 100% income result that the linear model delivers. An 88% result may be fine if the couple knows that they may need to lean on the equity of their home to supplement their income.

Retirement planning is multi-dimension and requires second-level thinking. If you have any questions, feel free to get in touch.

Bryan

Quick Links

Privacy | Disclaimer | © 2019 Assante Wealth Management

Know your Advisor: IIROC Advisor Report

Assante Capital Management Ltd. is a Member of the Canadian Investor Protection Fund and Investment Industry Regulatory Organization of Canada. The services described may not be applicable or available with respect to all clients. Services and products may be provided by an Assante advisor or through affiliated or non-affiliated third parties. Some services and products may not be available through all Assante advisors. Services may change without notice. Insurance products and services are provided through Assante Estate and Insurance Services Inc.